Background

There is a maximum amount of pension saving that you can build up in any one year before incurring a tax charge. This is known as the ‘annual allowance (AA)’ and includes benefits build up in the HSC Pension Service as well as other pension savings. The annual allowance is set by HM Revenue and Customs (HMRC) and is currently £60,000. Your annual allowance may be tapered down to a lower limit from 6th April 2020 if you have a taxable income of more than £200,000, this increased to £260,000 from 6th April 2023. Your annual allowance may be lower if you have flexibility accessed any defined contribution pension provisions.

In the HSC Pension Scheme, the annual allowance is commonly worked out by the growth in your benefit in a particular year.

The limit for the tax year 2010/11 was £255,000. This reduced to £50,000 a year from 6 April 2011.

Subsequently, from 6 April 2014 the AA reduced to £40,000 a year.

The vast majority of HSC Pension Scheme members will not be affected. These changes will primarily affect high earners. However, this can vary depending on the length of pensionable service and the rate of pensionable pay increase in any particular year.

If you exceed the annual allowance you will need to declare your pension savings amount on your tax return and may have to pay any excess at your marginal rate of income tax.

The AA is calculated as the growth in your benefits in a year. The AA limit covers all your pensions, except your state pension, therefore all other pension savings need to be added together.

Please also familiarise yourself on further changes made from years 2015/16 and 2016/2017.

Spring Budget Update 2023

Further to the Spring Budget in March 2023, the annual allowance limit increased from £40,000 to £60,000 from 6th April 2023.

In the event that you exceed the AA and are subject to a charge you may be eligible to opt for Scheme Pays. This is where a member elects for the relevant pension scheme to pay the charge on their behalf. The HSC Pension Service will only pay the AA charge if the scheme receives a Scheme Pay election notification and the member meets the mandatory requirements prescribed by HMRC. Where a Scheme Pays election is made, the member’s benefits are reduced in line with factors provided by the scheme actuary.

The Guides below provide further information about AA statements, charges and the Scheme Pays option.

- Annual Allowance Pension Savings Statement Guide

-

Process for Calculating the Annual Allowance

HSC Pension Service – Process for calculating the Annual Allowance

The Annual Allowance is calculated by deducting the opening value of a members benefits, adjusted for inflation, from the closing value of the members benefits in any tax year.

The opening value is the value of a members benefits at the beginning of the pension input period converted into a capital value, which is increased by the CPI from the previous September.

The closing value is the value of a members benefits at the end of the pension input period converted into a capital value.

The pension input period (PIP) is the period over which growth in a members pension saving is assessed; the pension input period for both the HSC Pension Scheme and HSC AVC Scheme is 1 April to the following 31 March until 31 March 2015. From 1 April 2015, the PIP was changed to end on 5 April 2016 and subsequent PIP’s will run from 6 April to the following 5 April.

The pension input amount (PIA) is the monetary amount a members savings have grown by in the pension input period and is calculated by determining the difference between the opening and closing values.

Pension Input Amount Calculations

The pension input amount is the increase or growth in the value of a member’s benefits over the pension input period. The amount of benefit growth in the HSC Pension Scheme is not based on the amount of employee or employer contributions paid but is the difference between the value of benefits at the start of the pension input period (the opening value) compared with the value at the end of the pension input period (the closing value).

The relevant tax year is the year in which the pension input period ends.

A member has a pension input amount if they were active for all or part of the pension input period. This includes if they cease active membership during the pension input period, for example, where they leave the Scheme to defer, to retire or transfer out their HSCPS benefits.

The Opening Value

The opening value is determined as follows.

1. Calculate the member’s HSCPS benefits up to the day before the beginning of pension input period.

2. Multiply the annual pension by 16.

3. For a 1995 Section member calculate their lump sum and add this to the amount at step 2.

(For a 2008 section member there will be no lump sum calculated, even if they made the Choice to move from the 1995 to the 2008 Section).

4. Increase the total after step 3 by the Consumer Price Index (CPI).Below is a table of the CPI increases used for Annual Allowance.

Tax year of Pension Input Period CPI 2008/09 1.8% 2009/10 5.2% 2010/11 1.1% 2011/12 3.1% 2012/13 5.2% 2013/14 2.2% 2014/15 2.7% 2015/16 2.5%* 2016/17 0.0% 2017/18 1.0% * HMRC confirmed that the increase on the opening value for 2015/16, only, was 2.5% and not CPI.

The Closing Value:

The closing value is determined as follows.

1. Calculate the member’s HSCPS benefits up to the end of the pension input period.

2. Multiply the annual pension by 16.

3. For a 1995 Section member calculate their lump sum and add this to the amount at step 2. (For a 2008 Section member there will be no lump sum calculated, even if they made the Choice to move from the 1995 to the 2008 Section).Calculating the pension input amount

To find the growth in HSCPS benefits simply subtract the opening value from the closing value. If the difference is a negative amount then the pension input amount is nil.

Further Considerations

Adjustment to the closing value:

Certain events can cause the closing value of the member’s benefits to be bigger or smaller than they would otherwise be. These events include where:

- a transfer payment has been made or received or,

- following a pension share order (because of divorce) there is a pension debit or credit attached to the member’s benefits, or

- the member leaves active membership and retires

In these circumstances an adjustment must be made to the amount of the closing value in the pension input period during which the event occurred.

If there has been a transfer in during the pension input period from a non-Club Scheme

The transfer in membership credit is ignored when calculating the closing value for the pension input period during which the transfer in payment was received. The transfer in membership credit will be included in both the opening and closing values for the next pension input period.

If there has been a transfer in during the pension input period from a Club Scheme from 28 January 2015

The transfer in membership credit is ignored when calculating the closing value for the pension input period during which the transfer in payment was received. The transfer in membership credit will be included in both the opening and closing values for the next pension input period if the transfer was completed before 28 January 2015.

If the transfer was completed on or after 28 January 2015 the transfer in membership credit will be included in the calculation of the pension input amount in the pension input period the transfer was received.

If there has been a transfer out during the pension input period

Where there has been a transfer out then the pension input period ends on the last day of pensionable membership.

If there has been a pension debit during the pension input period

The pension debit is ignored when calculating the closing value for the pension input period during which the pension share order became effective i.e. the opening and closing values will be calculated on the members unreduced benefits. The pension debit will be deducted from HSCPS benefits when calculating both the opening and closing values for the next pension input period.

If there has been a pension credit during the pension input period

The pension credit is a separate deferred arrangement and is therefore ignored when calculating the opening and closing value for the pension input period.

If there has been a crystallisation of HSCPS benefits during the pension input period

Where an active member retires the pension input period ends on the benefit crystallisation event (BCE) date.

Pension input amount of nil

The pension input amount is nil if during the pension input period a member:

- dies;

- retires because of ill health and meets HMRC’s severe ill health condition;

- has been deferred for the whole of the pension input period;

- has been deferred for part of the pension input period who then retires;

- leaves the scheme and has a refund of contributions;

- has pension credit benefits only.

Or maybe nil in circumstances where there is a negative amount either because:

- the pensionable pay used to calculate benefits for the opening value is higher than that used to calculate benefits for the closing value, and/or

- the growth in CPI, used in the opening value outweighs the actual growth of the HSCPS benefits.

-

Tapered AA from 6th April 2016 Factsheet

Information about the Tapered Annual Allowance from 6 April 2016

Tapered Annual Allowance

The Government has introduced Tapered Annual Allowance from 6 April 2016 as a means to further reduce the Annual Allowance. It works by reducing a person’s Annual Allowance by £1 for every £2 of ‘adjusted income’ earned over £150,000, up to a maximum reduction of £30,000 leaving a minimum Tapered Annual Allowance of £10,000.

Members with an adjusted income of between £150,000 and £210,000 will be affected by the Tapered Annual Allowance from the 2016/17 tax year.

Those with an adjusted income of over £210,000 will have a Tapered Annual Allowance of £10,000.

Members with a threshold income of less than £110,000 will be exempt from the Tapered Annual Allowance. As at present, any unused Annual Allowance from the three previous tax years can be carried forward and added to the individual’s Annual Allowance. Where this Annual Allowance is reduced by the taper, the carry forward will be the balance of the tapered amount.

Tapered Annual Allowance is based on an Annual Allowance of £40,000, so the rate of the taper may vary if the annual allowance is changed in the future.

Adjusted income (£150,000 and over)

Adjusted income is the total of all sources of taxable income falling in the tax year plus the value of any pension saving in that year. This is to ensure that the restriction applies fairly and cannot be avoided, for example, through using salary sacrifice.

There are seven steps for members to consider when calculating their adjusted income.

1. Identify the amounts of income on which the member is charged to income tax for the tax year.

The main types of chargeable income are:

- employment income,

- trading income (income from trades and professions),

- property income,

- pension income,

- social security income (where it is taxable),

- savings income,

- dividend income, and

- miscellaneous income.

2. Deduct from total income the amount of any relief under a provision listed in the Income Tax Act 2007 to which the member is entitled for the tax year.

There are two pension scheme related reliefs: excess relief where relief under a net pay arrangement is not sufficient, and relief on making a claim.

There are numerous other reliefs set out in the Income Tax Act 2007 that may be deducted at this step.

3. Add back in the amount of any claim for excess relief under net pay and relief on making a claim (described in step 2 above).

4. Add in the amount of any pension contributions made from any employment income of the individual for the tax year under net pay (but not any elements already added back in under step 3 above). This is to ensure fairness between those who have contributions deducted via net pay.

5. Add in the amount of relief claimed where non-domiciled individuals make contributions to overseas pension schemes.

6. Add in the value of any employer contributions for the tax year. The normal calculation basis for the Annual Allowance should be used. In the HSC Pension Scheme, this is the pension input amount for the tax year minus the amount of member contributions.

7. Deduct the amount of any lump sum death benefit accruing to the individual in the tax year from the death of a member over age 75/pre age 75 where not paid before end of relevant two year period. This will apply to those lump sums that are currently subject to the special lump sum death benefit charge (45%), but will instead, from 6 April 2016, be taxed at the recipient’s marginal rate of tax.

Threshold income (£110,000 and over)

To provide some certainty for Scheme administrators and members over who may be affected, and to ensure that lower paid individuals are not affected, the taper restriction will be subject to an income floor. The threshold income will be £110,000 (being £150,000 less the Annual Allowance) of what is normally a member’s net income for the tax year and will be known as threshold income.

Where an individual has threshold income of £110,000 or less they cannot be subject to the tapered Annual Allowance regardless of the level of their adjusted income.

There are five steps for members to consider when calculating their threshold income.

Steps 1 and 2 are the same as for adjusted income above.

3. Add in the amount of any employment income given up for pension provision as a result of any salary sacrifice made on or after 9 July 2015.

4. Deduct the gross amount of any pension contribution made via the relief at source method.

5. Deduct the amount of any lump sum death benefit accruing to the individual in the tax year from the death of a member over age 75/pre age 75 where not paid before end of relevant two year period.

Maximum tax relievable contributions

If, in a tax year, a member does not know what their final earnings and other income will be then they will not know where they fall within the taper range for the Annual Allowance (unless they are definitely above or below the range).

Consequently they will not know how much their maximum tax relievable pension contributions can be for that year.

This uncertainty might be because a member receives a large pensionable or non-pensionable payment at the end of the tax year or receives separate income from outside the HSC.

Money Purchase Annual Allowance

From 6 April 2016, members who have flexibly accessed their defined contribution pension savings will continue to have a money purchase Annual Allowance of £10,000. However, where this applies the alternative Annual Allowance, normally £30,000, against which their defined benefit savings are tested, will be restricted by the Tapered Annual Allowance rules. This means that for those with incomes of £210,000 or more, they will have an alternative Annual Allowance of £0 although any available used Annual Allowance can be carried forward and added to this.

Information to be provided by employers

As a result of the pension input period from 2016/17 onwards being the same as the tax year (6 April to 5 April) employers will need to provide information on the additional five days (1 April to 5 April) when they provide the Scheme year updates.

Annual Allowance Charge

Members have an obligation to include the Annual Allowance Charge information on their tax return by the following 31st January.

Pension Saving Statement timescales for 2016/17 onwards

The HSC Pension Scheme must provide a Pension Savings Statement to members who exceed the Annual Allowance by the 6 October following the end of the tax year that gave rise to the charge, provided the employer has supplied relevant information by 6 July.

The inclusion of all types of taxable contributable income in the definition of adjusted income will make the identification members affected by the Tapered Annual Allowance difficult because only the member or an accountant will hold the required information. In many cases this might not be possible until the relevant tax year has ended.

Registered pension schemes are awaiting further information from HMRC about the provision of information required to members.

Until an update from HMRC is available members with higher salaries should seek independent financial advice in connection with the calculation of their adjusted income and threshold income, taking account of earnings received from various sources, to identify whether their Annual Allowance is to be tapered from 2016/17 onwards.

Members who calculate that they have an adjusted income of between £150,000 and £210,000 should then consider requesting a Pension Savings Statement from HSC Pensions.

Principal or Assistant Medical Practitioners or non GP providers will only receive a statement once details from their Annual Certificate of Pensionable Profit have been received.

-

Tapered AA Example

In addition to her pensionable pay of £131,343*, Dr Jones received £10,000 of investment income and has allowable reliefs of £5,000 during the 2016/2017 tax year. Her pension contributions were £19,045 (i.e. 14.5% of £131,343).

*HSC Pension Service is only notified of a member’s pensionable pay – for the purposes of this example Dr Jones’ pensionable and taxable HSC pay are assumed to be the same.

Step 1 – Checking the threshold income

HMRC confirm that:

The tapered annual allowance restriction is subject to an income floor of £110,000 known as ‘threshold income’. This definition is based on the individual’s taxable income after allowing for certain reliefs plus the value of certain pension-related salary sacrifice type arrangements.

An individual with threshold income of £110,000 or less for a tax year is not subject to the tapered annual allowance, regardless of the level of their adjusted income for that tax year.

In light of HMRC’s guidance Dr Jones must check her threshold income first.

To determine if Dr Jones’ Annual Allowance will be tapered, her threshold income is compared against HMRC’s £110,000 limit:

As her threshold income is greater than £110,000 she may be subject to a Tapered Annual Allowance and must next check her adjusted income.

Step 2 – Checking the Adjusted Income

HMRC confirm that:

The adjusted income is based on the individual’s taxable income after allowing for certain reliefs plus the value of their pension savings during the tax year. The annual allowance is reduced by £1 for every £2 of income above £150,000. Where the reduction would otherwise take an individual’s tapered annual allowance below £10,000 for the tax year, their reduced annual allowance for that year is set at £10,000.

To determine whether Dr Jones’ adjusted income is greater than HMRC’s £150,000 limit her threshold income and pension input amount are added together. Her pension savings statement for 2016/2017 confirmed a pension input amount of £62,089.34:

Threshold Income £117,298.00 Plus Pension Input Amount £62,089.34 Adjusted Income £179, 387.34 Step 3 – Tapered Annual Allowance

As a consequence of her adjusted income being greater than £150,000 Dr Jones has a Tapered Annual Allowance. The standard Annual Allowance is tapered by £1 for every £2 that Dr Jones’ adjusted income exceeds £150,000.

Her adjusted income is £29,387.34 more that HMRC’s £150,000 limit (£179,387.34 – £150,000) and as a result her Tapered Annual Allowance is £25,306.33 (£40,000 – (£29,387.34 ÷ 2)).

Step 4 – Comparing the pension input amount against the Tapered Annual Allowance

Dr. Jones was sent a 2016/2017 pension savings statement confirming a pension input amount of £62,089.34.

She realises that she may have to pay an Annual Allowance charge on the £36,783.01 over her Tapered Annual Allowance of £25,306.33.

Step 5 – Calculating the Annual Allowance charge

Dr Jones can carry forward any unused Annual Allowance from the three previous tax years and add this to her Tapered Annual Allowance to offset against an Annual Allowance charge.

She has the following unused Annual Allowance to carry forward:

She has a total of £13,513.56 of unused Annual Allowance to carry forward.

This means her Annual Allowance charge will be based on a chargeable amount of £23,269.45. Her marginal tax rate for 2016/2017 was 45% therefore her charge is £10,471.25.

- Tapered Annual Allowance Calculator

-

Annual Allowance FAQ's

These Frequently Asked Questions are spilt up into sections. They should be read in conjunction with the other materials provided on the HSC Pension Service website.

1. General Questions

Q. What is Annual Allowance?

A. The Annual Allowance is the maximum amount of tax-free growth an Individual’s pension savings can grow by in any one year. If individuals exceed this limit they will need to pay an Annual Allowance tax charge to HMRC.

Q. When was it changed?

A. From the 6 April 2011 the annual allowance was reduced from £255,000 to £50,000. This was then reduced to £40,000 from 6 April 2014.

Q. What is included in the Annual Allowance?

A. The annual allowance limit covers all pension savings, except State Pensions, so any pension savings such as the HSC Pension Scheme and AVCs or personal pensions will need to be included.

Q. How is the Annual Allowance worked out for my HSC contributions?

A. For the main HSC Scheme it is the growth in benefits from one year to the next taking into account inflation (which is measured using the Consumer Price Index (CPI) method. For the HSC Money Purchase AVC Scheme it is the amount of contributions you have paid into the scheme.

Q. Can I work out what my annual pension growth has been from my HSC Pension Scheme contributions?

A. No. In defined benefit schemes such as the HSC Pension Scheme the annual allowance is not based on the contributions that are paid into the Scheme, but is based on the growth in the value of the member’s benefits.

Q. Does the Annual Allowance apply for me?

A. For most members the annual allowance will not affect them. However, any of the following could impact on the growth of your pension savings:- Being a high earner with long pensionable membership;

- Significant increase in membership (e.g. a change from part-time to full-time, doubled Mental Health Officer membership).

- purchasing added years or additional pension

- a significant pay rise, possibly due to a promotion.

- Receipt of a clinical excellence award

- Ill health retirement with an enhancement to you membership

- Contributions paid to other pension savings arrangements, including the HSC Money Purchase Additional Voluntary (MPAVC) Scheme.

Q. Am I at risk of exceeding the annual allowance?

A. The vast majority of members will not be affected. Early indications are that the changes will primarily affect high earners (those earning over £150,000 a year). You may also be affected if you earn less than £150,000 but:- you receive a significant pay rise or are promoted to a higher paid role; or

- have a long period of pensionable service, or;

- Earn pension at a higher rate than the normal Scheme accrual. Members on lower salaries can be affected if they receive a large one off increase in pensionable pay.The following may increase your chance of breaching the annual allowance limit:

- Paying significant amounts of additional pension.

- Linking of previous service in the HSC Pension Scheme.

- Paying significant amounts of pension contributions outside the HSC Pension Scheme.

- Taking Tier 2 Ill Health retirement.

However, in these circumstances, up to three previous years of unused ‘carry forward’ allowance may be used to reduce or offset the subsequent excess above the annual allowance.

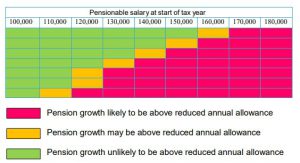

The table below gives an example of how this could impact HSC Pension Scheme members from 6 April 2011.

The table shows which employees may be affected if pay increases by 5% and inflation is 3%.

Different levels of pay increases and inflation can result in different people being affected.

2. Questions regarding how the Annual Allowance is calculated?

Q. How is the annual allowance calculated?

A. In defined benefit schemes such as the HSC Pension Scheme the annual allowance is not based on the contributions that you pay into the Scheme, but is based on the growth in the value of your benefits. The growth in your benefits is measured over a “Pension Input Period” which is normally 1 April to the following 31 March in the HSC Pension Scheme.Q. What is a Pension Input Period?

A. This is the 365 day period over which the growth in your pensions savings is assessed. The pension input period for the HSC Pension Scheme and HSC Money Purchase Additional Voluntary Contribution (MPAVC) was 1 April to 31st March up to 2014/15. From 2015/16 the pension input period is 6th April to 5th April in line with the Tax Year.Q. What is a Pension Input Amount?

A. This is the monetary amount your pension savings have grown by in the pension input period. For the HSC Pension Scheme this is based on the growth in your benefits, for the HSC Money Purchase scheme it is based on the contributions you have paid. It is calculated by determining the difference between the value of your benefits at the start of the pension input period (the opening value) compared with the value at the end of the pension input period (the closing value).For the HSC Money Purchase AVC Scheme it is simply the amount of contributions paid into the fund during the period.

Q. What is included in the Pension Input Amount?

A. The growth in your HSC Pension Scheme benefits including any doubled years, added years or additional pension being purchased. It does not include the Late Retirement increases in the 2008 Section.For the HSC Money Purchase AVC Scheme the amount of contributions you pay counts against your annual allowance.

3. Informing you about the Annual Allowance

Q. How will I know if I am over the Annual Allowance limit?

A. If you are over the annual allowance limit then we will send you a Pension Savings Statement. If you do not receive a pensions saving statement (because the growth in your HSC benefits does not exceed the Annual Allowance) but you have more than one pension arrangement you may have to ask each pension provider (including HSC Pension Service) for one.Q. When will you write to me?

A. Provided all the relevant information is available to us from your Employer to calculate the pension input amount we will write to you by 6 October each year if you have exceeded the annual allowance.If we have not received all the information from your employer we will send you a pension saving statement within 3 months of receiving the information.

Q. When will you send me a Pensions Savings Statement if I request one?

A. Provided we have received all the relevant information from your employer to calculate the pension input amount we will write to you by 6 October or within 3 months of receiving your request (requests can only be accepted from 1 April following the relevant tax year).Q. What is a Pensions Savings Statement?

A. It is HMRC’s name for the information that a pension scheme must send to members who are over the annual allowance or request annual allowance information.Q. Can I get information from HSC Pension Service about the annual

allowance even when I do not exceed the limit?

A. Yes. Members will be able to request Pension Saving Statements from HSC Pension Service on demand from 6th July 2013 (for tax years 2011/12 and 2012/13) if necessary. Remember you would only need these if you have other pension scheme membership and need to add them together to determine your overall position.Q. What about my contributions to other pension arrangements?

A. Your total pension savings are subject to the annual allowance test so any contributions you are paying to other registered pension schemes will also need to be included when calculating how much your pension has grown by in any one year.Q. What is my responsibility in terms of disclosing my annual allowance position to HMRC?

A. It is a member’s responsibility to ensure that any annual allowance tax charges are worked out, declared and paid in time. HM Revenue and Customs (HMRC) rules require that members who are over the Annual Allowance and who have tax to pay must do so via self-assessment or via the Scheme Pays process if they meet the criteria. For 2011/12 the self-assessment deadline for declaring and paying any tax due is 31 January 2013.The HM Revenue and Customs self-assessment process enables members to estimate any tax payable on their tax return. Members will then have 12 months in which to correct any estimated information provided. Members wishing to find out more should visit the HMRC website at: www.hmrc.gov.uk.

4. Exemptions from the Annual Allowance Charges

Q. I have a protection certificate from HMRC, does this affect my annual allowance?

A. No. Enhanced, Primary or Fixed Protection will not protect you from potential annual allowance charges from 6 April 2011.Q. Are there any exclusions from potential annual allowance charges?

A. Yes. If a member meets HMRC’s Severe Ill Health Condition (SIHC) or dies in year then HMRC deem that there is no Pension Input Amount (PIA) for that tax-year.Q. What is the Severe Ill Health Condition (SHIC)?

A. This is where the member either:- becomes entitled to a serious ill-health lump sum, or

- The Scheme Administrator receives evidence from a registered medical practitioner that the member is unlikely to be able to do any type of gainful work, other than in an insignificant way, before state pension age.

Q. I am retiring on ill health grounds, how do I know if I will be affected?

A. Members who retire on ill health grounds are not automatically excluded from annual allowance charges. If you are retiring on ill health grounds, you are more likely to be affected if you are eligible for ill health benefits which provide an enhancement to your pension and lump sum.This normally happens when you are awarded “Tier 2” ill health retirement benefits. Any growth in excess of the annual allowance may be partially or fully offset by the “carry forward” allowance.

HMRC have stated that their “Severe Ill Health” Test must be met in order for an individual to be exempt from the annual allowance in the year that they retire on ill health grounds.

The HMRC Severe Ill Health test is different, and in addition to the test members of the HSC Pension Scheme need to undergo in order to assess whether they qualify for ill health retirement benefits under the HSC Pension Scheme.

As part of your ill health application you may be asked whether you consent to the additional HMRC test being undertaken. This test can help to establish whether or not you are exempt from any annual allowance charge in the tax year that you retire. However, if the test is undertaken you may still be subject to an annual allowance charge, depending on the outcome of the test.

More information about the test can be found at: www.hmrc.gov.uk

Q. What is Carry Forward?

A. If you exceed the annual allowance in any one year you can ‘look back’ up to three previous tax years to see if you have any unused allowance from these years. If you do, you may be able to “carry forward” any unused allowance and add this to your allowance in the current year. This means that if your pension’s growth exceeds the £40,000 in any one year, say due to a promotion, you may not have any extra tax to pay, depending upon your personal circumstances.The maximum amount that can be carried forward is £40,000 for each of the 3 previous tax years, and is calculated on the current annual allowance rules. It is your responsibility to check whether you have an unused annual allowance from the preceding 3 tax years to carry forward to the tax year being assessed. The Pension Saving Statements provided by HSC Pension Service will include the pension input amounts for the previous 3 tax years.

5. Scheme Pays

Q. What is Scheme Pays?

A. If you have asked your pension provider to pay your annual allowance charge this is known as “Scheme Pays”. HSC Pension Service will provide the Scheme Pays facility. This can only be used when certain criteria are met. More information surrounding the criteria can be found in Scheme Pays Election Guide. In simple terms Scheme Pays can be thought of as following – In effect HSC Pension Service is loaning you money now to pay your current tax bill which it will receive back when you retire from your accumulated pension benefits.Q. I am considering Scheme Pays – what is an irrevocable election?

A. It is your decision to opt for Scheme Pays. It means that your decision cannot be revoked or withdrawn at a later date, but it may be amended if the amount of the annual allowance charge changes.Q. When do I have to tell HSC Pension Service I want to use Scheme Pays?

Depending on the weather Scheme Pays is ‘Mandatory’ or ‘Voluntary’ the deadlines may vary.More information surrounding the criteria can be found in Scheme Pays Election Guide.

Q. When will the Scheme Pays amount be recovered?

A. In the HSC Pension Scheme the amount will usually be recovered when your benefits are paid at retirement, or if you transfer out of this scheme. From the HSC Money Purchase AVC Scheme it will be taken from your pension fund/pot when the charge is paid to HMRC.Q. How will it be recovered?

A. By permanently reducing your pension and in the 1995 Section your lump sum as well.Q. How much will it cost me?

A. The HSC Pensions Scheme will add interest to any Scheme Pays amount. Interest will be based on the CPI figure every September plus the Superannuation Contributions Adjusted for Past Experience (SCAPE) discount rate. SCAPE is variable and is currently 2.4%. This figure will be recovered from your award of benefits by factors or directly from any transfer amount. Any Scheme Pays amount will be recovered directly from your HSC Money Purchase AVC fund if this has been requested.Q. What and when is the relevant date?

A. The relevant date is the date from which interest is added to the amount of the Scheme Pays.Q. What happens if I die?

A. If you die whilst a member of the HSC Pension Scheme, then any recovery due because of Scheme Pays will be written off and your estate will receive the same level of benefits as if you did not utilize Scheme Pays. If you are in the Money Purchase AVC Scheme any benefits will be based on your pension fund after the reduction for Scheme Pays.Q. Will it affect my dependent’s benefits?

A. In the HSC Pension Scheme your dependents benefits will be based on your pension before any recovery for Scheme Pays. In the HSC Money Purchase AVC Scheme it will be based on the value of your fund with which you buy an annuity after the reduction for Scheme Pays.Q. What happens if I exceed the annual allowance again?

A. The process will be repeated for each occasion Scheme Pays is requested.6. HSC Money Purchase Scheme

Q. What about the HSC Money Purchase Scheme

A. This is a separate scheme to the HSC Pension Scheme and any contributions paid to the HSC Money Purchase AVC Scheme needs to be added to the growth in the HSC Pension Scheme. HSC Pension Service will only write to you if you have exceeded the annual allowance limit in either Scheme. It will not write to you if your combined growth from the HSC Pension Scheme and contributions to the HSC Money Purchase AVC Scheme exceeds the annual allowance limit.Q. How will the annual allowance within the HSC Money Purchase Scheme be worked out?

A. The Pension Input Amount for the HSC Money Purchase AVC Scheme is based on the contributions paid into the fund during the Pension Input Period.Q. I pay to more than one HSC Money Purchase AVC Provider, what do I have to do?

A. If you pay to more than one provider then you will need to add the contributions paid to each provider to work out the total Pension Input Amount.Q. Does it have the same Pension Input Period as the main HSC Pension Scheme?

A. Yes. The pension input period is 6 April to 5 April.7. Miscellaneous Questions

Q. I am thinking of buying Additional Pension, how do I know if it will be affected?

A. When Additional Pension is purchased; this increases a member’s pension beyond any normal increases. This is more likely to affect higher earners, especially if they also have longer service.If you are buying additional pension by lump sum of in excess of £2,500 pension then you are much more likely to be affected by the annual allowance.

Q. What happens if I am made redundant?

A. If you are being made redundant, you will not be affected if your Pensions’ growth is usually below the annual allowance unless you receive an enhancement to your pensionable service. Any growth in excess of the annual allowance may be partially or fully offset by “carry forward” allowance. Other redundancy payments which do not affect your pension or lump sum are not included in the annual allowance test.Q. Is my State Pension affected by annual allowance?

A. The growth in your State Pension is not affected by the annual allowance limits. -

Exemptions from Annual Allowance Calculator

HSC Pension Service – Exemptions from the

Annual Allowance chargeThere are a number of circumstances from which you can be exempt from the Annual Allowance charge. These are set out in this factsheet.

If a member:

- meets HMRCs Severe Ill Health Condition (SIHC)

- dies or

- is a deferred member for the full pension input period

during the relevant tax year then their pension input amount for that tax year will be nil. From 6 April 2011 having Enhanced Protection, Primary Protection, Fixed Protection 2012, Fixed Protection 2014 or Individual Protection will not protect a member from potential Annual Allowance charges.

The Severe Ill Health Condition is where a member either:

- becomes entitled to a serious ill health lump sum because their life expectancy is less than one year, or

- HSC Pension Service receives evidence from a registered medical practitioner that the member is unlikely to be able to do any type of gainful work, other than in an insignificant way, before State Pension Age

Members who retire on ill health grounds are not automatically excluded from Annual Allowance charges. If they retire on this basis they are more likely to be affected if they are eligible for benefits that provide an uplift to their pension and lump sum. This normally happens when they are awarded Tier 2 ill health retirement benefits.

HMRC have stated that the severe ill health condition is different to the conditions required to receive Tier 2. As part of the ill health application the member will be asked to consent in order for the Schemes Medical Advisors to assess whether they meet the Severe Ill Health Condition.

Exemption from Annual Allowance – FAQs

Q. I have a protection certificate from HMRC; does this affect my Annual Allowance Charge?

A. No. From 6 April 2011 having Enhanced Protection, Primary Protection, Fixed Protection 2012, Fixed Protection 2014 or Individual Protection will not protect you from potential annual allowance charges.Q. Are there any exclusions from potential Annual Allowance charges?

A. Yes. If a member:- meets HMRC’s Severe Ill Health Condition (SIHC),

- dies, or

- is a deferred member (for the full pension input period) during the relevant tax year then their pension input amount for that tax year only will be nil.

Q. I am retiring on ill health grounds, how do I know if I will be affected?

A. Members who retire on ill health grounds are not automatically excluded from Annual Allowance charges. If you are retiring on ill health grounds, you are more likely to be affected if you are eligible for ill health benefits which provide uplift to your pension and lump sum.This normally happens when you are awarded “Tier 2” ill health retirement benefits.. HMRC have stated that their “Severe Ill Health” condition must be met in order for an individual to be exempt from the annual allowance in the tax year they retire on ill health grounds.

HMRC’s Severe Ill Health Condition is different to the conditions required to receive Tier 2. As part of your ill health application you will be asked to consent in order for our medical advisers to assess whether you meet HMRC’s severe ill health condition. This test can help to establish whether or not you are exempt from any annual allowance charge in the tax year you retire.

Remember, any growth in excess of the Annual Allowance may be partially or fully offset if you have any unused annual allowance that you are able to carry forward.

Q. I am not an active member of the HSC Pension Scheme will I have a Pension Input Amount?

A. If you have been a deferred member for the whole of the input period (or a deferred member for part of the pension input period and retired) then you will have no pension input amount.Q. I am receiving a pension from the HSCPS will I have a pension input amount?

A. This depends when you went on pension and if you have paid any growth in your HSCPS benefits in a pension input period:

- If you retired from employment and took your benefits you will have a pension input amount for the time you accrued benefits in the HSCPS for that pension input period; And

- If your benefits are revised to take account late payments or extra membership, then this growth will be included in the pension input period the extra benefits are paid; or

- If your benefits were paid in an earlier pension input period and there were no revisions to your benefits then you will be a “pensioner member” and your pension input amount will be nil in any pension input period where there is no growth in benefits.

-

Annual Allowance - Additional Pension (AP) and Added Years (AY)

Reduced Annual Allowance – Additional Pension (AP) and Added Years (AY)

The Annual Allowance has been reduced from £255,000 to £50,000 from 6 April 2011. The Annual Allowance is the maximum tax-privileged amount of growth and contributions you can have in all your pension arrangements (excluding State pensions) in a tax year.

The value for Annual Allowance purposes in an Additional Pension (AP) and Added Years (AY) arrangement is the amount of AP or AY purchased multiplied by 16. Survivors and dependants pensions do not count toward the Annual Allowance and therefore any AP or AY value attributable to these pensions should be excluded for Annual Allowance purposes.

Any AP or AY already purchased or still being purchased must be included in the opening and closing balance when calculating the Pension Input Amount for any Pension Input Period. These terms are explained in more detail in the reduced Annual Allowance section of this website.

Additional Pension (AP)

AP is an option to buy extra annual pension, available in both the 1995 and 2008 Sections of the Scheme. If AP of £2,000 is purchased by a single payment, its value for Annual Allowance purposes under the rules for 2011/12 is £2,000 x 16

= £32,000 in the year of purchase. This amount will count towards the Annual Allowance of £50,000. Therefore the Annual Allowance remaining is £50,000 – £32,000 = £18,000 in this example*.AP may also be purchased by payment of instalments deducted from pay. In those circumstances the AP accrues on a pro-rata basis during the period the instalments are paid. For example, AP of £2,000 purchased over a four-year period that begins at the start of a tax year, will accrue at the rate of £500 a year. The value for Annual Allowance purposes will be £500 x 16 = £8,000, in each of the next four years*.

AP is re-valued by any increase in the rate of inflation between the month when the application to buy AP was received, and the second month before the pension is due for payment. The increase counts towards the Annual Allowance used in the year.

*The above examples assume that there is no increase in the rate of inflation and that no survivors or dependants pension has been purchased.

The growth is calculated differently under the main HSC Pension Scheme than it is for AP. Growth in the main HSC Pension Scheme also needs to be taken into account as do any other pension contributions, for example, to personal pensions.

Added Years (AY)

AY is a service based benefit available only in the 1995 Section of the Scheme. Each additional year purchased increases the service used to calculate scheme benefits. The service of members who work part-time is increased in proportion to the hours worked in the period when the added years are purchased.

AY benefits for HSC staff

Under an AY contract members usually contribute a fixed percentage of their pensionable pay for an agreed number of years. Contracts begin from a members birthday and normally end when he or she reaches age 60 or 65 (members of the special classes can also choose age 55). The service purchased accrues on a pro-rata basis during the period of the contract. For example, a contract to buy 5 added years, which began at age 50 and is due to be completed at age 60, will accrue extra service at the rate of half a year, in each year of the contract.

AY are added to actual years of service and the total used to calculate benefits as follows:

Pensionable pay x total years service x 1/80 = pension

Pensionable pay x total years service x 3/80 = lump sum*

(*The lump sum is normally reduced in respect of membership before 25 March 1972.)

This method of calculation also applies to practitioners when they work in salaried hospital/community service when buying AY.AY benefits for Practitioners

Practitioners receive benefits based on their re-valued career earnings. This is achieved by re-valuing the pensionable earnings received in each year of practitioner service to calculate the total up-rated earnings. The pension is 1.4% of the total up-rated earnings. In keeping with this method of calculating benefits practitioners are credited with extra pensionable pay for each AY purchased. The extra pay is the annual average of the re-valued pensionable earnings during the period of the AY contract. At retirement the extra pay is added to the pensionable earnings in the year when the contract ends or in the final year of membership, if that is earlier.For AA purposes the proportion of AY pay and membership purchased in the PIP is included in the opening and closing values.

The basic practitioner benefits are:

Total up-rated pensionable pay (including added years) x 1.4% = pension

Total up-rated pensionable pay (including added years) x 4.2% = lump sum*(*The lump sum is normally reduced in respect of membership before 25 March 1972.)

Notes on Practitioner benefit calculations

HSC Pension Scheme regulations provide a number of flexibilities for the calculation of benefits when a practitioner has also undertaken work as an HSC staff member in salaried hospital / community service.

Subject to the regulations this might result in:

The basic practitioner benefits being increased by a conversion factor which takes account of salaried hospital / community service before becoming a practitioner. AY service is included in the factor.Separate staff member benefits being paid for salaried hospital / community service. If worked whilst buying AY, the separate benefits will include an AY service credit.

Pay from salaried hospital / community service worked concurrently with practitioner service being included in the practitioner benefit calculation. If worked whilst buying AY the salary is also included in the practitioner AY calculation, described above.

AY in the 2008 Section

AY cannot be purchased in the 2008 Section but any already purchased in the

1995 Section are included in the service which transfers to the 2008 Section under Choice. The transferred service, including AY, is subject to an adjustment if the member is over age 60 on 1 October 2009. Once service has been transferred benefits are calculated in accordance with the rules of the 2008 Section.When you are considering purchasing AP or AY, you should consider whether you may be affected by the Annual Allowance limit.

- Scheme Pays-Election Guide 2017/18 Onwards

-

SPE2 2017/18 Onwards

HSC Pension Scheme (HSCPS) (Northern Ireland) – Annual Allowance Scheme Pays Election

You should only complete this election if you want the 1995/2008 HSCPS and/or the 2015 HSCPS to pay some or all of your annual allowance charge that relates to the HSCPS.

Annual allowance

The standard annual allowance is currently £40,000. More information about the tapered and alternative annual allowance is in the Pension Savings Statement Guide on our website.

Your annual allowance covers all your pension schemes. You do not have a separate annual allowance for each pension scheme you are a member of.

If you exceed your available annual allowance in more than one tax year a separate SPE2 must be completed for each tax year.

Scheme pays facility

We have two scheme pays facilities; mandatory scheme pays and voluntary scheme pays.

Mandatory scheme pays – this is only available if your pension input amount, in either the 1995/2008 HSCPS or the 2015 HSCPS is more than £40,000.

Voluntary scheme pays facility – this is available if you are a member of both the 1995/2008 HSC Pension Scheme and the 2015 HSCPS and your pension input amounts in both HSC schemes, when added together, is more than your available annual allowance.

Voluntary scheme pays facility is available from 2017/18 onwards if you have an annual allowance charge as a result of having an available annual allowance lower than £40,000. Also, from 2017/18 you no longer have to have an annual allowance charge of more than £2,000.

You can now ask us to pay up to 100% of your annual allowance charge that relates to your HSC benefits as long as we receive your election before the deadline.

We will notify you what we will pay and whether it will be paid by mandatory or voluntary scheme pays, or both facilities. Members of both the 1995/2008 HSC Pension Scheme and the 2015 HSC Pension Scheme who want both HSC schemes to pay the annual allowance charge need to complete both Election 1 and Election 2.

You need to tell us how much of the annual allowance charge you want each HSC scheme to pay. Because these are separate elections you need to complete Election 1 and Election 2 before the deadline. It is not possible to elect for one HSC Pension Scheme to pay all your charge.

More information about the maximum amount of scheme pays we will pay from each HSC scheme can be found in the Scheme Pays Election Guide.

Annual Allowance Scheme Pays (SPE2) for 2017/18 onwards

Guidance on how to complete a SPE2 form can be found in the below tab.

- SPE2 Guidance & Completion Notes up to 2016/17

- Scheme Pays Election - SPEC2 (up to 2016/17)

-

Annual Allowance Notice 2021/2022

Introduction

- Pensions is a topic that many find very confusing, and we know that from our direct engagement with some of you particularly over the last year, so combine pensions with tax, which is exactly what Annual Allowance is about – and we do realise that this takes the sense of confusion to a whole different level.

- The purpose of this notice is to provide you with information and clarity to dispel the confusion. So please read on and do not panic….

What is “Annual Allowance”?

- The Annual Allowance, which is set by HM Revenue and Customs is the maximum amount of pension savings you can make in any one tax year that benefits from tax relief. Annual Allowance is very much a tax matter and therefore outside the control of HSC Pension Service. However, we do have a key role to play in identifying and notifying those of you likely to “breach” the Annual Allowance and provide you with information on what options you have to address any breach. The onus is on you to seek independent financial advice as necessary, to decide on which course of action you wish to take.

Will this affect me?

4. The good news is that, based on past experience of the numbers affected, we know that only a small percentage of members will be impacted by this issue. If you are one of those impacted then we will email and let you know by 6th October this year.

5. If the growth in your pension savings in any one year is more than the Annual Allowance you may be liable to pay tax on the amount that is over the allowance. The Annual Allowance is currently £40,000 and is calculated as 16 times the increase in the value of your pension during the year, plus the increase in value of any automatic lump sum (1995 Scheme only) and calculated as 16 times the increase in the value of your pension during the year (2008 and 2015 CARE Scheme only.

6. You will need to know which pension scheme or pension arrangement you are in and you can find this information on your last Annual Benefit Statement to help you see if you are likely to breach your Annual Allowance.

7. Factors which may impact you include:

- a significant increase in pensionable pay (for example, promotion or temporary promotion. However, it is important to note that an increase in pensionable pay will also provide increased pension benefits.);

- buying a lot of Added Pension;

- combined (aggregated) separate periods of membership in the HSC pension schemes e.g. 1995 Scheme plus 2015 Scheme membership;

- if you retire on tier 2 ill health grounds;

8. It is really important that you realise that if you have any other pension savings outside of the HSC Pension schemes these also contribute to using up your Annual Allowance. HSC Pension Service will not be aware of this when we issue you with information.

Where can I find out more?

9. HSC Pension Service has a dedicated Annual Allowance Team to deal with your queries and can be contacted on AAQueries@hscni.net .

10. You are also encouraged to check the Pensions and Tax section on the HSC Pension Service website which includes detailed information on Annual Allowance and is updated regularly.

Tax Information – HSC Pension Service (hscni.net)

11. We will be providing regular updates throughout the year to support those of you who we identify as having breached the Annual Allowance in the 2021/22 tax year. The list below lets you know what you can expect from us.

- HMRC deadlines you must adhere to.

- Annual Allowance information is available by 6 October 2022 on the Member Self-service (MSS) for all members. If you have not registered for this service you can do so at https://mypension.hscni.net/

Group Information Sessions may be offered to those of you who are directly affected by Annual Allowance.

12. Finally, if you have any questions specific to the Annual Allowance please remember to send them to our dedicated Annual Allowance Team at AAQueries@hscni.net – and remember – do not panic!

-

HMRC Estimator Tool

-

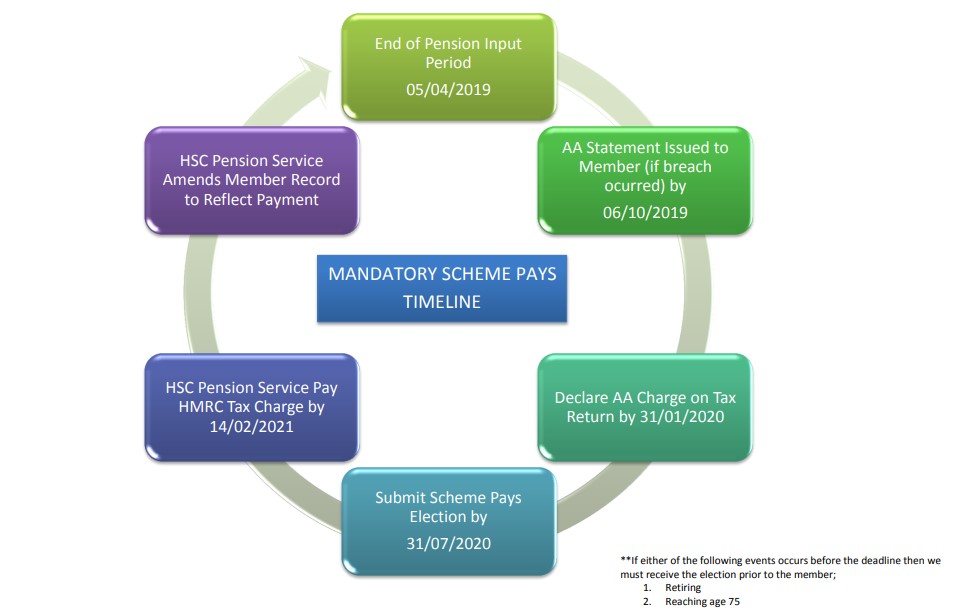

Mandatory Scheme Pays Timeline

-

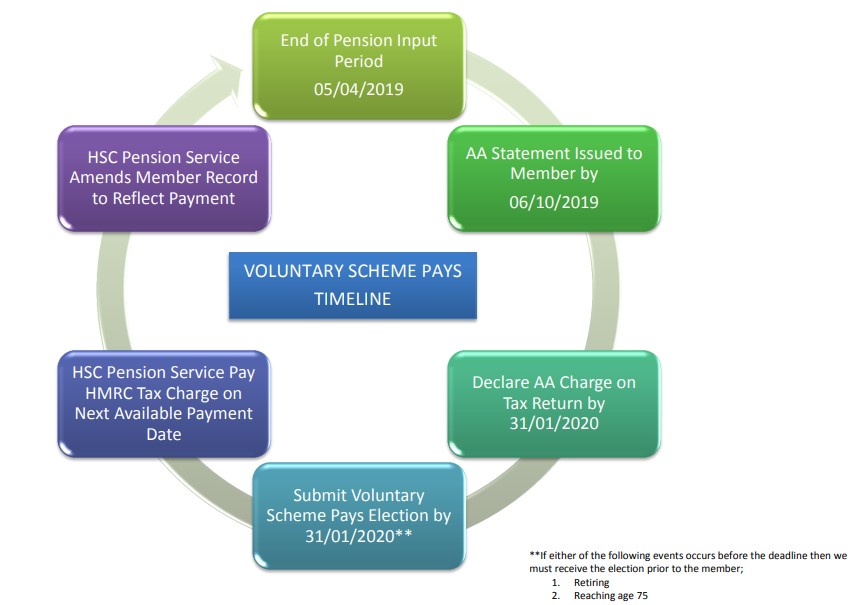

Voluntary Scheme Pays Timeline

Business Services Organisation

Business Services Organisation