These Frequently Asked Questions are spilt up into sections. They should be read in conjunction with the other materials provided on the HSC Pension Service website.

1. General Questions

Q. What is Annual Allowance?

A. The Annual Allowance is the maximum amount of tax-free growth an Individual’s pension savings can grow by in any one year. If individuals exceed this limit they will need to pay an Annual Allowance tax charge to HMRC.

Q. When was it changed?

A. From the 6 April 2011 the annual allowance was reduced from £255,000 to £50,000. This was then reduced to £40,000 from 6 April 2014.

Q. What is included in the Annual Allowance?

A. The annual allowance limit covers all pension savings, except State Pensions, so any pension savings such as the HSC Pension Scheme and AVCs or personal pensions will need to be included.

Q. How is the Annual Allowance worked out for my HSC contributions?

A. For the main HSC Scheme it is the growth in benefits from one year to the next taking into account inflation (which is measured using the Consumer Price Index (CPI) method. For the HSC Money Purchase AVC Scheme it is the amount of contributions you have paid into the scheme.

Q. Can I work out what my annual pension growth has been from my HSC Pension Scheme contributions?

A. No. In defined benefit schemes such as the HSC Pension Scheme the annual allowance is not based on the contributions that are paid into the Scheme, but is based on the growth in the value of the member’s benefits.

Q. Does the Annual Allowance apply for me?

A. For most members the annual allowance will not affect them. However, any of the following could impact on the growth of your pension savings:

- Being a high earner with long pensionable membership;

- Significant increase in membership (e.g. a change from part-time to full-time, doubled Mental Health Officer membership).

- purchasing added years or additional pension

- a significant pay rise, possibly due to a promotion.

- Receipt of a clinical excellence award

- Ill health retirement with an enhancement to you membership

- Contributions paid to other pension savings arrangements, including the HSC Money Purchase Additional Voluntary (MPAVC) Scheme.

Q. Am I at risk of exceeding the annual allowance?

A. The vast majority of members will not be affected. Early indications are that the changes will primarily affect high earners (those earning over £150,000 a year). You may also be affected if you earn less than £150,000 but:

- you receive a significant pay rise or are promoted to a higher paid role; or

- have a long period of pensionable service, or;

- Earn pension at a higher rate than the normal Scheme accrual. Members on lower salaries can be affected if they receive a large one off increase in pensionable pay.The following may increase your chance of breaching the annual allowance limit:

- Paying significant amounts of additional pension.

- Linking of previous service in the HSC Pension Scheme.

- Paying significant amounts of pension contributions outside the HSC Pension Scheme.

- Taking Tier 2 Ill Health retirement.

However, in these circumstances, up to three previous years of unused ‘carry forward’ allowance may be used to reduce or offset the subsequent excess above the annual allowance.

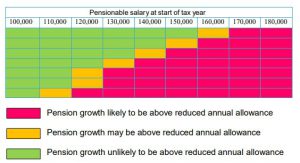

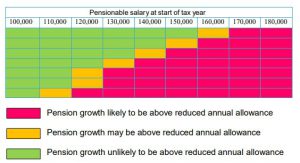

The table below gives an example of how this could impact HSC Pension Scheme members from 6 April 2011.

The table shows which employees may be affected if pay increases by 5% and inflation is 3%.

Different levels of pay increases and inflation can result in different people being affected.

2. Questions regarding how the Annual Allowance is calculated?

Q. How is the annual allowance calculated?

A. In defined benefit schemes such as the HSC Pension Scheme the annual allowance is not based on the contributions that you pay into the Scheme, but is based on the growth in the value of your benefits. The growth in your benefits is measured over a “Pension Input Period” which is normally 1 April to the following 31 March in the HSC Pension Scheme.

Q. What is a Pension Input Period?

A. This is the 365 day period over which the growth in your pensions savings is assessed. The pension input period for the HSC Pension Scheme and HSC Money Purchase Additional Voluntary Contribution (MPAVC) was 1 April to 31st March up to 2014/15. From 2015/16 the pension input period is 6th April to 5th April in line with the Tax Year.

Q. What is a Pension Input Amount?

A. This is the monetary amount your pension savings have grown by in the pension input period. For the HSC Pension Scheme this is based on the growth in your benefits, for the HSC Money Purchase scheme it is based on the contributions you have paid. It is calculated by determining the difference between the value of your benefits at the start of the pension input period (the opening value) compared with the value at the end of the pension input period (the closing value).

For the HSC Money Purchase AVC Scheme it is simply the amount of contributions paid into the fund during the period.

Q. What is included in the Pension Input Amount?

A. The growth in your HSC Pension Scheme benefits including any doubled years, added years or additional pension being purchased. It does not include the Late Retirement increases in the 2008 Section.

For the HSC Money Purchase AVC Scheme the amount of contributions you pay counts against your annual allowance.

3. Informing you about the Annual Allowance

Q. How will I know if I am over the Annual Allowance limit?

A. If you are over the annual allowance limit then we will send you a Pension Savings Statement. If you do not receive a pensions saving statement (because the growth in your HSC benefits does not exceed the Annual Allowance) but you have more than one pension arrangement you may have to ask each pension provider (including HSC Pension Service) for one.

Q. When will you write to me?

A. Provided all the relevant information is available to us from your Employer to calculate the pension input amount we will write to you by 6 October each year if you have exceeded the annual allowance.

If we have not received all the information from your employer we will send you a pension saving statement within 3 months of receiving the information.

Q. When will you send me a Pensions Savings Statement if I request one?

A. Provided we have received all the relevant information from your employer to calculate the pension input amount we will write to you by 6 October or within 3 months of receiving your request (requests can only be accepted from 1 April following the relevant tax year).

Q. What is a Pensions Savings Statement?

A. It is HMRC’s name for the information that a pension scheme must send to members who are over the annual allowance or request annual allowance information.

Q. Can I get information from HSC Pension Service about the annual

allowance even when I do not exceed the limit?

A. Yes. Members will be able to request Pension Saving Statements from HSC Pension Service on demand from 6th July 2013 (for tax years 2011/12 and 2012/13) if necessary. Remember you would only need these if you have other pension scheme membership and need to add them together to determine your overall position.

Q. What about my contributions to other pension arrangements?

A. Your total pension savings are subject to the annual allowance test so any contributions you are paying to other registered pension schemes will also need to be included when calculating how much your pension has grown by in any one year.

Q. What is my responsibility in terms of disclosing my annual allowance position to HMRC?

A. It is a member’s responsibility to ensure that any annual allowance tax charges are worked out, declared and paid in time. HM Revenue and Customs (HMRC) rules require that members who are over the Annual Allowance and who have tax to pay must do so via self-assessment or via the Scheme Pays process if they meet the criteria. For 2011/12 the self-assessment deadline for declaring and paying any tax due is 31 January 2013.

The HM Revenue and Customs self-assessment process enables members to estimate any tax payable on their tax return. Members will then have 12 months in which to correct any estimated information provided. Members wishing to find out more should visit the HMRC website at: www.hmrc.gov.uk.

4. Exemptions from the Annual Allowance Charges

Q. I have a protection certificate from HMRC, does this affect my annual allowance?

A. No. Enhanced, Primary or Fixed Protection will not protect you from potential annual allowance charges from 6 April 2011.

Q. Are there any exclusions from potential annual allowance charges?

A. Yes. If a member meets HMRC’s Severe Ill Health Condition (SIHC) or dies in year then HMRC deem that there is no Pension Input Amount (PIA) for that tax-year.

Q. What is the Severe Ill Health Condition (SHIC)?

A. This is where the member either:

- becomes entitled to a serious ill-health lump sum, or

- The Scheme Administrator receives evidence from a registered medical practitioner that the member is unlikely to be able to do any type of gainful work, other than in an insignificant way, before state pension age.

Q. I am retiring on ill health grounds, how do I know if I will be affected?

A. Members who retire on ill health grounds are not automatically excluded from annual allowance charges. If you are retiring on ill health grounds, you are more likely to be affected if you are eligible for ill health benefits which provide an enhancement to your pension and lump sum.

This normally happens when you are awarded “Tier 2” ill health retirement benefits. Any growth in excess of the annual allowance may be partially or fully offset by the “carry forward” allowance.

HMRC have stated that their “Severe Ill Health” Test must be met in order for an individual to be exempt from the annual allowance in the year that they retire on ill health grounds.

The HMRC Severe Ill Health test is different, and in addition to the test members of the HSC Pension Scheme need to undergo in order to assess whether they qualify for ill health retirement benefits under the HSC Pension Scheme.

As part of your ill health application you may be asked whether you consent to the additional HMRC test being undertaken. This test can help to establish whether or not you are exempt from any annual allowance charge in the tax year that you retire. However, if the test is undertaken you may still be subject to an annual allowance charge, depending on the outcome of the test.

More information about the test can be found at: www.hmrc.gov.uk

Q. What is Carry Forward?

A. If you exceed the annual allowance in any one year you can ‘look back’ up to three previous tax years to see if you have any unused allowance from these years. If you do, you may be able to “carry forward” any unused allowance and add this to your allowance in the current year. This means that if your pension’s growth exceeds the £40,000 in any one year, say due to a promotion, you may not have any extra tax to pay, depending upon your personal circumstances.

The maximum amount that can be carried forward is £40,000 for each of the 3 previous tax years, and is calculated on the current annual allowance rules. It is your responsibility to check whether you have an unused annual allowance from the preceding 3 tax years to carry forward to the tax year being assessed. The Pension Saving Statements provided by HSC Pension Service will include the pension input amounts for the previous 3 tax years.

5. Scheme Pays

Q. What is Scheme Pays?

A. If you have asked your pension provider to pay your annual allowance charge this is known as “Scheme Pays”. HSC Pension Service will provide the Scheme Pays facility. This can only be used when certain criteria are met. More information surrounding the criteria can be found in Scheme Pays Election Guide. In simple terms Scheme Pays can be thought of as following – In effect HSC Pension Service is loaning you money now to pay your current tax bill which it will receive back when you retire from your accumulated pension benefits.

Q. I am considering Scheme Pays – what is an irrevocable election?

A. It is your decision to opt for Scheme Pays. It means that your decision cannot be revoked or withdrawn at a later date, but it may be amended if the amount of the annual allowance charge changes.

Q. When do I have to tell HSC Pension Service I want to use Scheme Pays?

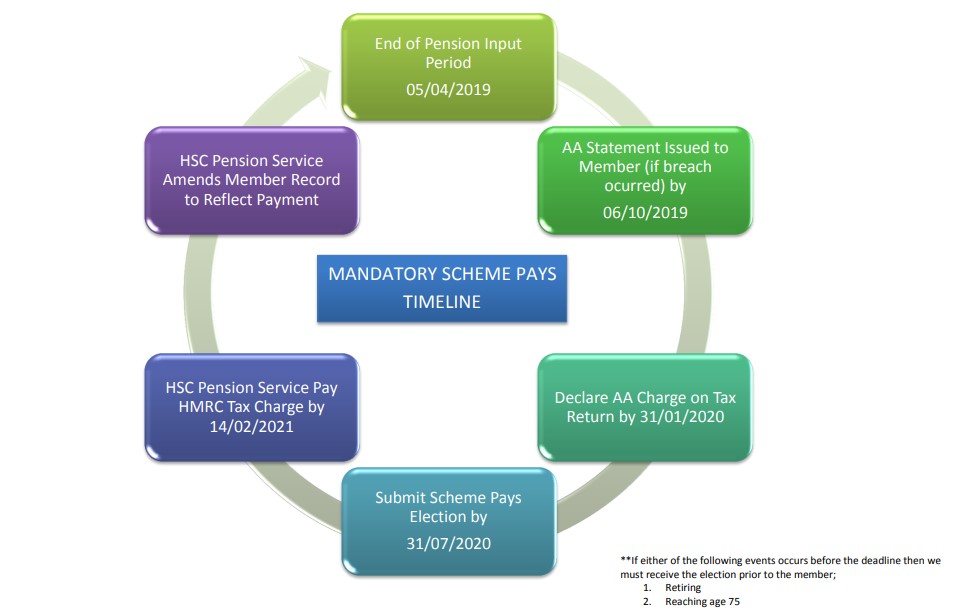

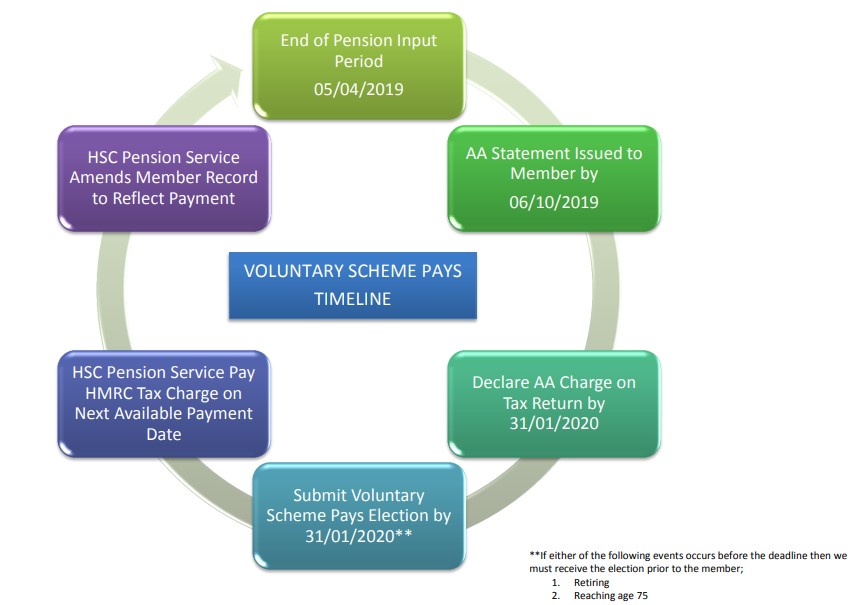

Depending on the weather Scheme Pays is ‘Mandatory’ or ‘Voluntary’ the deadlines may vary.

More information surrounding the criteria can be found in Scheme Pays Election Guide.

Q. When will the Scheme Pays amount be recovered?

A. In the HSC Pension Scheme the amount will usually be recovered when your benefits are paid at retirement, or if you transfer out of this scheme. From the HSC Money Purchase AVC Scheme it will be taken from your pension fund/pot when the charge is paid to HMRC.

Q. How will it be recovered?

A. By permanently reducing your pension and in the 1995 Section your lump sum as well.

Q. How much will it cost me?

A. The HSC Pensions Scheme will add interest to any Scheme Pays amount. Interest will be based on the CPI figure every September plus the Superannuation Contributions Adjusted for Past Experience (SCAPE) discount rate. SCAPE is variable and is currently 2.4%. This figure will be recovered from your award of benefits by factors or directly from any transfer amount. Any Scheme Pays amount will be recovered directly from your HSC Money Purchase AVC fund if this has been requested.

Q. What and when is the relevant date?

A. The relevant date is the date from which interest is added to the amount of the Scheme Pays.

Q. What happens if I die?

A. If you die whilst a member of the HSC Pension Scheme, then any recovery due because of Scheme Pays will be written off and your estate will receive the same level of benefits as if you did not utilize Scheme Pays. If you are in the Money Purchase AVC Scheme any benefits will be based on your pension fund after the reduction for Scheme Pays.

Q. Will it affect my dependent’s benefits?

A. In the HSC Pension Scheme your dependents benefits will be based on your pension before any recovery for Scheme Pays. In the HSC Money Purchase AVC Scheme it will be based on the value of your fund with which you buy an annuity after the reduction for Scheme Pays.

Q. What happens if I exceed the annual allowance again?

A. The process will be repeated for each occasion Scheme Pays is requested.

6. HSC Money Purchase Scheme

Q. What about the HSC Money Purchase Scheme

A. This is a separate scheme to the HSC Pension Scheme and any contributions paid to the HSC Money Purchase AVC Scheme needs to be added to the growth in the HSC Pension Scheme. HSC Pension Service will only write to you if you have exceeded the annual allowance limit in either Scheme. It will not write to you if your combined growth from the HSC Pension Scheme and contributions to the HSC Money Purchase AVC Scheme exceeds the annual allowance limit.

Q. How will the annual allowance within the HSC Money Purchase Scheme be worked out?

A. The Pension Input Amount for the HSC Money Purchase AVC Scheme is based on the contributions paid into the fund during the Pension Input Period.

Q. I pay to more than one HSC Money Purchase AVC Provider, what do I have to do?

A. If you pay to more than one provider then you will need to add the contributions paid to each provider to work out the total Pension Input Amount.

Q. Does it have the same Pension Input Period as the main HSC Pension Scheme?

A. Yes. The pension input period is 6 April to 5 April.

7. Miscellaneous Questions

Q. I am thinking of buying Additional Pension, how do I know if it will be affected?

A. When Additional Pension is purchased; this increases a member’s pension beyond any normal increases. This is more likely to affect higher earners, especially if they also have longer service.

If you are buying additional pension by lump sum of in excess of £2,500 pension then you are much more likely to be affected by the annual allowance.

Q. What happens if I am made redundant?

A. If you are being made redundant, you will not be affected if your Pensions’ growth is usually below the annual allowance unless you receive an enhancement to your pensionable service. Any growth in excess of the annual allowance may be partially or fully offset by “carry forward” allowance. Other redundancy payments which do not affect your pension or lump sum are not included in the annual allowance test.

Q. Is my State Pension affected by annual allowance?

A. The growth in your State Pension is not affected by the annual allowance limits.

Business Services Organisation

Business Services Organisation