In this section you can find information surrounding your membership, contributions and pay as a member of the HSC Pension scheme.

For information on ways in which you can increase your pension benefits, please see Increasing your Benefits: Additional Pension/Added Years/ERRBO.

- Membership

-

Contributions

The costs of the Scheme are determined by the Government and also the Scheme Actuary who performs periodic valuations of the Scheme to determine how much needs to be paid in to provide the benefits paid out. These costs are shared between the HSC employers and the Scheme members.

As a Scheme member you pay a contribution towards your pension based upon your pensionable pay. The more you earn, the higher your contribution rate may be. Your employer pays the remainder of the pension contribution.

There are currently eleven rates of member contribution, starting from 5.2% of pensionable pay for the lowest earners and this increases based on their actual pensionable pay. If the overall cost of the Scheme increases, the amount you pay may also increase. These eleven rates will be compressed into 6 rates in the year 2023/24 (date to be confirmed)

Contributions are taken from pay before tax so members receive tax relief on any amount they pay. Members may also pay a lower rate of National Insurance. This can reduce the actual amount that they pay depending on their contribution rate, earnings level and personal rate of tax. You will find a factsheet on the links below for the Scheme years 2015/2016 through to 31 October 2022. On 01 November 2022 the rates changed and details are available on the HSC Pension Scheme Contribution Rates from 1 November 2022 factsheet.

The rules in respect of tiered contributions apply to all members of the HSC Pension Scheme.

Your employer contributes an amount equal to 22.5% of your pensionable pay.

HSC Pension Scheme Contribution Rates from 1 November 2022

The Department of Health (DoH) has introduced changes to the amount members pay towards their HSC pension.

The DOH has updated the pensionable pay ranges used to decide how much you contribute to your pension, and the percentage of your pay you’ll pay to be a member of the Scheme.

The amount you pay will be based on your actual annual rate of pay, instead of your whole-time equivalent. This means if you’re part-time, you may pay less as your contribution rate will be based on how much you’re paid each year, instead of how much you would earn if you worked full time.

The changes help to reduce the gap between the different tiers of contribution rates.

To give members time to adjust the DOH is phasing in the new contribution rates in two stages, starting on 1 November 2022 with further changes planned in 2023:

Pensionable salary ranges from 1st November 2022 Contribution rates from 1st November 2022 (based on actual annual pensionable pay): Future planned contribution rates (based on actual annual pensionable pay): Up to £13,246 5.1% 5.2% £13,247 to £16,831 5.7% 6.5% £16,832 to £22,878 6.1% 6.5% £22,879 to £23,948 6.8% 6.5% £23,949 to £28,223 7.7% 8.3% £28,224 to £29,179 8.8% 8.3% £29,180 to £43,805 9.8% 9.8% £43,806 to £49,245 10% 10.7% £49,246 to £56,163 11.6% 10.7% £56,164 to £72,030 12.5% 12.5% £72,031 and above 13.5% 12.5% The pensionable salary ranges have been amended to reflect the outcome of the DoH’s recent consultation on uplifting the contribution tier boundaries to reflect the Agenda for Change pay increase for 2022/23. This includes increasing the upper boundary of tier 1 from £13,231 to £13,246 and the lower boundary of tier 2 from £13,232 to £13,247 as announced in the consultation outcome.

These salary ranges will change each year in line with any annual increase to Agenda for Change pay scales. This means that members will be less likely to move into a higher contribution tier as a result of a national pay award.

If you are a practitioner

If you are a practitioner, you already pay contributions based on your total annual practitioner pensionable pay. This won’t change, but now all members are members of the 2015 Scheme your practitioner pay may be annualised and the updated salary ranges will apply to you.

If you also work in an officer post, for example as a salaried hospital doctor, your contribution rates will be calculated separately and may be different for your officer and practitioner pensionable pay.

You can view previous years tiered contributions for 2015/2016 until 2021/22 here.

-

Pay

The Pay used to work out your Pension

Introduction

Like most ‘final-salary’ pension schemes, your pension from the HSC Pension Scheme is worked out as a portion of your annual pay for each year (or part year) you are a member. The annual pay figure used is calculated using your pay in the run-up to your retirement.

In the 1995 Section the annual pay figure used is called ‘Final Year’s Pensionable Pay’, in the 2008 Section it is called ‘Reckonable Pay’ and in the 2015 CARE scheme it is the actual pensionable pay. Each are worked out differently. This factsheet explains the difference between these figures.

Is it worked out differently if I work part-time?

For the 1995 and 2008 section of the scheme – No. If you work part-time Final Year’s Pensionable Pay and Reckonable Pay both use the full-time equivalent of your actual pensionable pay. If you work full-time your actual pensionable pay is used.

For the 2015 scheme your actual earnings are used when calculating your pension, regardless if you are part time or full time.

How is Final Year’s Pensionable Pay worked out for the 1995 Section?

Final Year’s Pensionable Pay is simply the highest pensionable pay of your last three years of service. Usually this is your last year.

How is Reckonable Pay worked out for the 2008 Section?

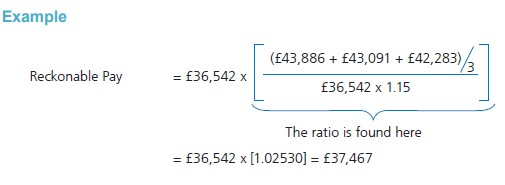

Working out Reckonable Pay can be complex because it looks back over a longer period and uses an annual average of three consecutive years’ pay rather than a single year. Here’s how it works:

- We look at your last 10 years of pay (from 1 April 2008 at the earliest) and revalue it to what it is worth on the day you retire. This is done so each year’s pay can be compared in like terms to today’s earnings.

- We find the best three consecutive years over this 10 year period and calculate the average of these three years. We do this using the actual amounts, rather than the revalued amounts.

- We adjust this average to bring the earliest two of the three years up to date with the last of the three years.

- Your pension is then calculated using this ‘Reckonable Pay’. If the

earnings used to calculate your pension are not from your last year of working, it is revalued again to what it is worth on the day you retire.

What if I have been in the 2008 Section for less than three years?

If you have been in the 2008 Section for less than three years when you retire we work out the annual average for the period you have been in the 2008 Section.

How does it work in practice?

There are some examples below of how Reckonable Pay is used to calculate your pension. For the purpose of these examples, the members’ service is worked out for a full year from 1 April – 31 March. However a year could run from any given date within the year depending on when you retire.John’s pension using Reckonable Pay

John retires on 1 April 2020 on his 65th birthday. He started in the 1995 Section on 1st April 1990 and made the choice to move to the 2008 Section. John has 30 years’ membership and moved to a job that paid less five years before retirement.

The table shows John’s full time equivalent (FTE) pensionable pay up to 10 years before he retired. It also shows the increase factor and what his revalued (increased) pay would be.

Year 1 2 3 4 5 6 7 8 9 10 From 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 To 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 FTE Pensionable Pay £25,390 £24,770 £24,165 £23,575 £23,000 £38,162 £36,518 £34,945 £33,440 £32,000 Increase Factor 1 1.03 1.06 1.09 1.12 1.15 1.18 1.21 1.24 1.27 Revalued Pay £25,390 £25,516 £25,615 £25,697 £25,760 £43,886 £43,091 £42,283 £41,466 £40,640 The best three consecutive years’ are years 6, 7 and 8. The annual average of these three years before they are revalued is:

(£38,162 + £36,518 + £34,945) / 3 = £36,542

To find out what John’s Reckonable Pay is, we revalue the earlier two years of the three by multiplying the average by 1.02530.

Reckonable Pay = £36,542 x 1.02530 = £37,467

John’s pension (before he takes a lump sum) would be:

Pension = 30 / 60 x £37,467 = £18,734 x 1.15 = £21,544

John’s pension using Final Pensionable Pay

If John had chosen to stay in the 1995 Section then his Final Pensionable Pay would be used (£25,390) and his pension would be:

30/80 x £25,390 = £9,521

John’s pension using Voluntary Pay Protection – 1995 Section

Because John moved to a job that paid less before he retired, he could choose Voluntary Pay Protection in the 1995 Section. If he did this, we would work out the benefits he had earned for each period of membership separately, based on the pensionable pay at the end of each period and then revalue it. He would get the highest rate as his pension.

25/80 x £38,162 = £11,926 x 1.15 = £13,715 plus 5/80 x £25,390 = £1,587 giving a total pension of £15,302.

The pension increase factor used to revalue the pension is 1.15.

This means that separate membership calculations are more beneficial for John’s pension. Had he chosen to remain in the 1995 section and protect his pay, he would get £15,302 instead of £9,521.

What is Voluntary Pay Protection?

If your earnings have reduced because you’ve moved to a job that pays less, you have a one-off chance to protect your higher pay. To do this you must have reached minimum pension age and your pay must be at least 10 percent less. 1995 Scheme OnlyJane’s pension using Reckonable Pay

Jane started in the 1995 Section on 1 April 1990 and chose to move to the 2008 Section. Jane retires on 1 April 2010 aged 65 with 30 years’ membership. Although Jane has more than three years in the HSC Pension Scheme, she has less than three years’ pay in the 2008 Section. Only the pay received when she moved to the 2008 Section is used to work out her pension.

Used for the 2008 Section Year 1 2 3 From 2009 2008 2007 To 2010 2009 2008 Pay £25,390 £24,770 £24,165 Increase Factor 1 1.03 1.06 Revalued Pay £25,390 £25,513 £25,615 Reckonable Pay = (£25,390 + £24,770) / 2 x 1.0148 = £25,451

Pension (before she takes a lump sum) = 30 / 60 x £25,451 = £12,726. Her pension is not revalued (increased) because it is worked out using up to date pay figures.

Jane’s pension using Final Pensionable Pay

If Jane had chosen to stay in the 1995 Section the pay that would have been used to work out her pension would have been Final Year’s Pensionable Pay (£25,390) and her pension would be:

30/80 x £25,390 = £9,521.

Adding Pensions Increase to the two earlier years when calculating Reckonable Pay (see ‘John’s pension using Reckonable Pay’)

When working out Reckonable Pay, each year’s pay in the last 10 years to retirement is increased to bring that pay figure up to what it would be worth on the day you retire. By doing this your past pay can be compared to your later pay in like terms. The revaluation factor used for this is called the pension increase factor.

However the legislation that ensures pensions are kept up to date with prices (the Pensions Increase Act 1971) insists that pensions are increased using the pension increase factor from the day after the day on which the pay used to calculate the pension was last paid.

If Reckonable Pay was the average of the three revalued years then the effect of the Pensions Increase Act would be to double-count pensions increase

- because the pay is first increased by it to find the best three years in

current terms and - because the pension is then also increased by it as required by the

Pensions Increase Act.

To avoid this double-counting of pension increase, the pension that is calculated Is based on the average of the best three consecutive years’ pay before revaluation.

However this is not entirely correct either as the earliest two years are still at their original value and the pension is only increased from the end of the last of the three years. So, the earliest two years are increased to be brought up to date with

the last of the three years.This is done by multiplying the average of the best three consecutive years ratio. The result of this is Reckonable Pay.

The ratio is between a pension calculated using the revalued annual average pay and a pension calculated using the average of the original pay figures, but also having Pension Increase applied to that pension (rather than the pay).

How to calculate pension using actual pay in the 2015 Scheme

From 1 April 2015 the new CARE (career average revalued earnings) scheme was introduced.

Pension is calculated by dividing the actual pensionable earnings by 54 and revaluing the resultant amount by CPI plus 1.5% each year until retirement. Each years revalued pension are then added together to get a final total pension payable.

Business Services Organisation

Business Services Organisation