| 2008 Section |

| When you take your benefits after age 65, any of your pension earned before age 65 will be increased to take account of the fact that it is being paid later than your Normal Pension Age. |

The guide for pensioners and their dependants is designed to answer your questions regarding your retirement and receiving your HSC Pension. You should read this booklet before applying for your benefits.

How to apply for your benefits

Active members

When considering retirement you should arrange to meet with your with your Line Manager to discuss your proposed retirement date. You should then complete an Online AW6 Pension Application and forward to your HR Department with a copy of your birth certificate. Your Line Manager should submit a Leaver Notice on HRPTS at the same time otherwise HR cannot process your application.

To ensure that you receive your benefits on time, the AW6 – Pension Application Form should be submitted to HR at least six months before your intended retirement date.

We recommend members view the HSCPS Scheme Guides and Calculators, which are available on this website.

Please see our below video on how to complete your online AW6 Form:

Ill health/Injury

Please go to this page for the information you will need to apply for an Ill-Health or Injury Pension.

More information can be found in the Guide for Pensioners and their Dependants available to view or download in our HSC Pension Scheme Guides section.

Payment of benefits

When you retire your pension is usually paid monthly in arrears into a UK bank account for the rest of your life. For those living abroad we can usually arrange to pay your benefits into a bank account there, providing it can accept secure electronic payments.

If you decide not to maintain a bank account in the UK, we can make payments direct to your bank account, held in the country specified on the bank mandate, in local currency.

HSC Pension Service are fully index-linked to protect against inflation. This means that your pension will be increased each year in line with the cost of living, for as long as it is paid. The increases are paid from April. In the first year of your retirement the amount of increase you get will depend on the date you retire.

Different benefits apply to the 1995/2008 section and the 2015 Section of the HSC Pension Scheme and also what type of member you are. To find out which section of the Scheme you belong to please refer to the flowchart in the Scheme Guide available on our Scheme Guide section.

For more information for General Practitioners please see the Practitioners section.

State Pension Scheme and other Pension Schemes

The Scheme is completely separate from the State pension arrangements or any other pension schemes you may have. This means that you will normally get a separate basic state pension as well as your HSC pension.

The Scheme is contracted out of the second level of state pension (known as the State Second Pension (or S2P)) and you will not get any additional pension from this, except for any contributions you may have made in another employment.

If you have arranged your own personal pension, or have pensions from other employment, these are payable as well as your pension from the Scheme but it is up to you to choose when you take these.

Because of pension tax legislation, you may need to tell us about these pensions arrangements including any that are already in payment, when you come to retire.

The HSC Retirement Fellowship

The Fellowship in Northern Ireland has the support and backing of the Department of Health, Social Services and Public Safety and all the various Health and Social Care bodies. Membership is open to all grades of staff in HSC services. The cost of membership is £6.00 per year which can be paid through a monthly deduction of 50p from your HSC Pension or by an annual payment. If you are interested in becoming a member, or would like some more information about the organisation further details can be found in the guide for pensioners and their dependants.

Scheme Facts

The HSC Pension Scheme is contracted-out of S2P under the 1995 Pensions Act. This means that the Scheme has to pass a scheme quality test set out in the Pensions Act. The Scheme actuary has confirmed that the Scheme has passed the test.

Click on the tabs below to find out more about the benefits at retirement and different types of retirement:

-

When Can I Retire?

Normal Pension Age

The Normal Pension Age is the age that you can retire from HSC employment and have your pension paid without reduction. The actual age that applies to you will depend on which section of the Scheme you are in and your status.

1995 Section The 1995 Section’s Normal Pension Age is 60. If you work beyond age 60 your pension will be paid when you eventually retire. If you have one HSC job you must retire from the job for at least 24 hours to qualify for your pension.

If you have two or more concurrent pensionable jobs in the HSC you are only required to retire for at least 24 hours in one of them provided that the remaining job(s) total 16 hours or less per week. However, you must cease to be pensionable in all your other job(s). If you are retired prematurely due to redundancy or interest of efficiency of the service, you should read the additional information in the Early Retirement section..

You may not rejoin the Scheme once you are in receipt of a pension. (Unless it is an Ill Health Retirement Pension and you are under age 50).

If you have Special Class status your normal pension age is 55. Further information on this can be found in the Special Class Status factsheet available in the scheme factsheets section of the website.

If you wish to take some or all of your pension before you are 60 it will be reduced because it will be paid for longer. Further details on this are included in the early retirement tab below.

Once you reach your 75th birthday you can no longer be a Scheme member and you will be entitled to receive your retirement pension from that date without a break in employment.

The maximum pension membership is 45 years. If you reach 45 years membership before your normal pension age your benefits will be deferred and paid to you when you choose to retire.

2008 Section The 2008 Section’s Normal Pension Age is 65. If you work beyond age 65 your pension will be paid when you eventually retire and it will be increased because it is being paid later.

You must stop work in all your jobs for at least 24 hours to qualify for all your retirement benefits, but a 24 hour break is not required if you partially retire.

If you wish to take some or all of your pension before you are 65 it will be reduced because it will be paid for longer. Further details on this are included in the early retirement tab below.

Once you reach your 75th birthday you can no longer be a Scheme member and you will be entitled to receive your retirement pension from that date without a break in employment.

The maximum pension membership is 45 years. If you reach 45 years membership before your normal pension age your benefits will be deferred and paid to you when you choose to retire.

Late Retirement

If you remain in employment after the Normal Pension Age, you may continue to earn benefits as long as you stay in the Scheme, up to age 75 (65 if you have Special Class Status) or until you reach 45 years Scheme membership. Your pension benefits will be based on your pensionable pay and membership when you do eventually retire. At age 75 you become entitled to your benefits without having to have a break in your employment.

1995 Section There are no provisions to increase any of your benefits because they are paid late. -

Early Retirement

Claiming your Preserved Benefits

At Retirement age you will need to complete the Preserved Benefit application form to claim your HSC Scheme Retirement Benefits, Form should be completed and forwarded to HSC Pension Service three months before the start date for payment of benefits.

Claiming your Preserved Benefits

1995 Section Members Only

Some former members with Preserved Benefits may be eligible to apply for their benefits early (a reduction will apply) before normal benefit age 60.

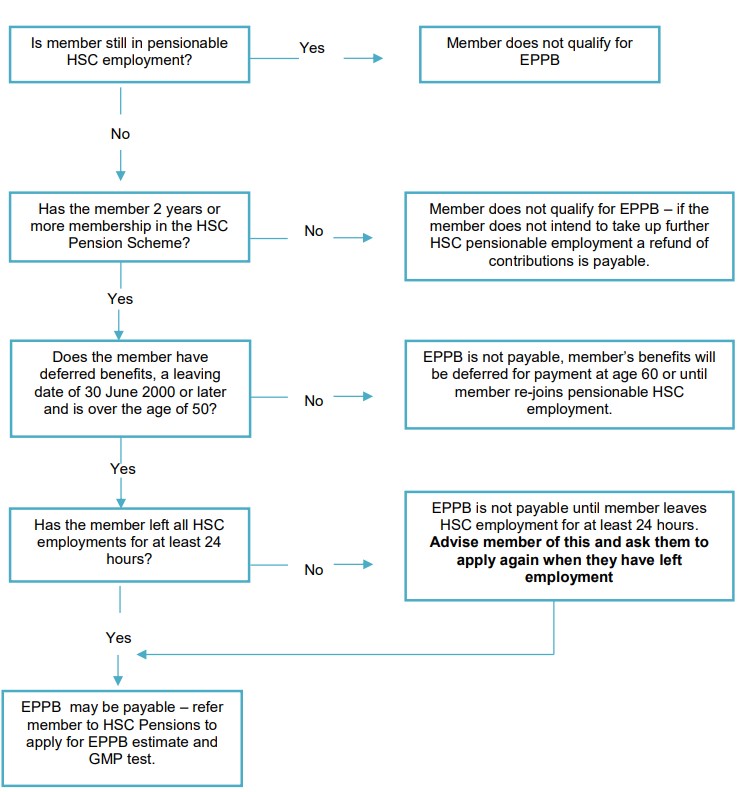

Please refer to the Decision Tree below to see if you are eligible to apply for Early Payment of Preserved Benefit.

Early Payment of Deferred Benefits (EPPB) Decision Tree -1995 Section

Changes to the HSC Pension Scheme effective from 1 April 2015 mean that there will be different sections of the Scheme. Please establish which section and the member’s normal retirement age before continuing.

Actuarially Reduced Early Retirement following Preservation (EPPB)

Benefits for Members – 1995 Section

Age

Members who leave the Scheme and/or HSC employment, without immediate entitlement to benefits, but retain deferred benefits in the Scheme for payment at age 60, are classed as deferred members.

For these members, benefits are normally payable at age 60 on age retirement grounds. From 30 June 2000 a new facility was introduced that allows members who leave the Scheme, on or after that date with deferred benefits, to claim them at any point between age 50 and 60 with an actuarial reduction. This is known as Early Payment of Preserved Benefits (EPPB).

Who can apply?

EPPB is available to ALL deferred members providing they were in pensionable HSC employment on or after 31 March 2000 and have two or more years’ membership in the HSC Pension Scheme.

In addition, a deferred member must not be in HSC work at the time of claiming the benefits. If they are still working but not paying pension contributions they need to take the 24-hour break from their employment.

When applying for EPPB, all applicants should be made fully aware of the financial implications of their decision such as:

- Not to make any definite plans until it has been confirmed that the actuarially reduced pension will satisfy the Guaranteed Minimum Pension conditions set out below;

- The actuarially reduced pension remains in payment for the pensioner’s lifetime; and

- The gross pension and lump sum are not restored at age 60; and

- The pension and lump sum are only payable from when a member first enquires about EPPB, or age 50, whichever is the latest.

EPPB is not allowed if the reduced pension is less than the GMP.

Consequently, if the early retirement costs are to be met by an actuarial reduction, the reduced pension must be at least equal to, or better than, the Statutory Standard (previously the GMP), as required under Social Security legislation.

If the reduced pension is not at least equal to the Statutory Standard/GMP the retirement on EPPB grounds is not permitted.

The only exception to this rule is a married woman paying reduced rate National Insurance Contributions (‘E’ rate), as these members are not subject to the GMP test.

What does it provide?

It provides an annual pension of 1/80

the of the best of the last 3 years pensionable pay for each year and part year of reckonable membership, plus a lump sum equal to three times the annual pension. However there are three exceptions where the lump sum will be lower.These are:

- For men who are/have been married, have membership before 25 March 1972 and have not purchased the full-unreduced lump sum; or

- For women who have decided to purchase the Bigger Widower’s pension by payment from their lump sum: or

- Where the member owes money to HSC Pensions or the employer for outstanding pension contributions and elects to repay this money from their lump sum.

These benefits are then reduced to take account of the benefits being taken earlier than a normal retirement age of 60.

How to apply?

If a former member approaches you about a claim for payment of actuarially reduced deferred benefits, please ask them to write directly to HSC Pension Service, giving their personal details, National Insurance number and the date they are thinking of taking their benefits.

HSC Pension Service will then apply the GMP test, and if the criteria are met, will respond by providing the member with an estimate of the basic deferred benefits and the actuarially reduced amounts for them to consider.

Once a member has confirmed to HSC Pension Service that they are happy to accept the reduced amounts payable, we will supply them with the application form AW6P.

On receipt of the completed forms AW6P HSC Pension Service will process the member’s application.

The accuracy of a HSC Award is dependent on the information recorded on the member’s pension record. It is vital that employers record accurate details of pension contributions, earnings and hours for each employee at the end of each financial year and up to the last day of membership. We may also contact you to confirm the total pensionable pay figure to be used in the calculation of benefits, if not already held, or ask that you provide us with an accurate pay figure as soon as possible.

-

Benefits at Retirement

This section describes the benefits that you can expect to receive from the Scheme when you retire.

HSC Staff, Practice and Approved Employer Staff earn pensions based on their pensionable pay at or near retirement, this is known as a ‘final salary’ pension.

Practitioners earn pensions based on their earnings throughout their career. These are revalued to maintain a current value and are known as Career Average Revalued Earnings (CARE) pensions.

Mixed employment – pension flexibilities

Practitioners who have also worked as NHS/HSC Staff or as a GP registrar may also have pension earned on the final salary method as well as on the CARE method.

Members who have this type of mixed employment will have additional calculations applied to their pension records to ensure that the most favourable benefits allowed by the flexibility rules are obtained for them.

Pension and lump sum

In both sections of the Scheme you will receive an annual pension. In the 1995 section you will also have a retirement lump sum. This will normally be three times your annual pension. Members of both Sections are able to give up some of their annual pension in exchange for an optional lump sum amount. This is called pension commutation and more information can be found in the ‘Pension Commutation – Increasing your lump sum’ tab below.

Providing for your dependants

If you are in good health you can choose to allocate (give up) part of your own pension to provide a bigger pension for any dependant on your death. This can be to a spouse, civil partner, qualifying partner, or child. The nomination must be made before you retire and you cannot reverse this decision once made. More Information can be found in the Allocation tab below.

Members working part time

For calculating benefits, membership means the actual membership you have accrued in the Scheme. So someone who has worked part time, say 50% of standard full time hours, for 20 years will have 10 years membership counting towards their benefit calculations. However, the other main factor in calculation benefits – final years pensionable pay, or reckonable pay – is based on the whole time equivalent salary for that job. So in the example the part time worker may have earned £10,000 a year but for the purpose of calculating benefits the full time rate of £20,000 is used.

-

Working after Retirement

You can return to work in the HSC after you’ve taken your pension. If you chose to, you can rejoin the HSC Pension Scheme and build up pension benefits in the 2015 Scheme up to the maximum pension age limit of 75.

Further information is available on our Re-employment section.

-

Premature Retirement

If your employer decides you are redundant (for example following

re-organisation) and- you have reached minimum pension age; and

- you have at least 2 years’ membership,

we can pay you a pension for life and a lump sum as an alternative to you receiving a severance payment from your employer.

How much will I get?

These benefits are worked out in the same way as normal retirement benefits but will not be reduced to take account of early payment.

What if I have more than one HSC job?

You have 2 choices. You can either;

- take redundancy benefits for Scheme membership in the redundant job only, or

- take redundancy benefits for Scheme membership in all your jobs. You would have to leave the jobs for at least one day before you could claim your redundancy benefits in this way.

2008 Section

Can I return to HSC work?

You can return to HSC work and rejoin the Scheme after redundancy, however your pension may be abated.

1995 Section

The information in this section applies ONLY to those who:

- are members of the 1995 Section of the HSC Pension Scheme; and

- were in HSC employment prior to 1 October 2006; and

- are made redundant before 1 October 2011; and

- at the date of redundancy have been a Scheme member for 5 or more years; and

- are NOT employed by GP Practices, Out of Hours (OOH) Providers, Alternative Providers of Medical Services (APMS), Specialist Personal Medical Services (SPMS) or working for most Direction Employers.

General

If you can satisfy certain continuity of employment or Scheme membership conditions, you can choose to have your benefits calculated by reference to transitional protection rules, which are explained in this section.

If this applies to you, you should consider your options carefully, because once you have made your choice your cannot change your mind. Your employer will provide you with quotations of your entitlements to help you decide.

Additional qualifying criteria for transitional protection

To qualify for your redundancy to be calculated under Transitional Protection measures you must have reached your minimum pension age and:

- have, or be regarded as having continuity of HSC employment prior

to 1 October 2006 or continuity of Scheme membership prior to 1 December 2006;

and - have 5 or more years’ Scheme membership at the date of redundancy.

Redundancies before 1 October 2011

You can have your benefits calculated with an element of enhancement, but the value of the enhancement will vary, depending on your date of redundancy.

This is achieved by calculating the pension value of the enhancement under the previous calculation method, at 30 September 2006. We use normal pensionable pay rules, and include membership enhancements shown in the section headed ‘Benefits if you are entitled to Transitional Protection’ below.

The value of the enhancement at 30 September 2006 is then reduced as time goes by, until it is extinguished where the redundancy date is 30 September 2011. Your employer will provide you with an estimate of this calculation.

Benefits if you are entitled to Transitional Protection

If you have been in the Scheme for up to 10 years, at 30 September 2006 :

Your membership at 30 September 2006 will be doubled, subject to the maximum you could have had by age 65, or any earlier retirement age written into your contract of employment.

Your total membership cannot be increased to more than 40 years. If you have ever worked part time your extra membership will be reduced to take account of this.

Redundancy payment from your employer

If you have to retire early because of redundancy and you choose to receive benefits under the Transitional Protection arrangements you will normally be entitled to a lump sum payment from your employer but this will be calculated under the old severance pay rules. Your employer can tell you more about this.

This lump sum will be reduced if the enhancement of your membership of the HSC Pension Scheme that you would have received as at 30 September 2006 is more than 6 2/3 years. The redundancy payment will be reduced by 30%, for each full extra year’s membership.

For example:

Extra Years Membership at 30/09/06 Reduction in Redundancy Pay 0 – 6 2/3rds 7

8

9

10

NIL 10%

40%

70%

100%

The reduction will be adjusted to take account of any part years.

Choosing your benefits

If you qualify for Transitional Protection and will be retiring early because of redundancy, your employer will arrange for you to receive an estimate of the benefits available under each set of rules and you may then choose which method is used to pay your pension benefits.

Consider the options carefully, once you have made your choice on your retirement benefits application for AW6 you cannot change your mind.

If you are paying additional contributions If you are:

- buying added years or a bigger lump sum for Scheme membership before 25 March 1972 by paying extra contributions from your pay; and/or

- buying Additional Pension (AP) by instalments; and

- you have been making the payment for at least 12 months, then

you cannot have a refund of those payments if you are forced to leave HSC employment early. You will be credited with the extra benefits you have already paid for but if you choose to claim your pension, the benefits you get from the additional contributions will be reduced because your benefits are being paid before your expected retirement date.

If this applies to you ask HSC Pensions for a quotation of how much will be payable.

If you have more than one HSC job

If you choose to claim your pension benefits you will have two choices, either:

- take your benefits for Scheme membership in the redundant job only, and still be a Scheme member in your other job(s), or

- take your benefits for Scheme membership in all your jobs. You would have to leave the jobs before you could claim in this way.

If you choose the first option further movements in and out of the Scheme are permitted. However, redundancy benefits may be affected when future retirement benefits are re-assessed. It is essential that you contact your employer or HSC Pension Service for further information.

If you choose the second option you will not be able to rejoin the Scheme if you return to HSC work. However, if you retire after 1 April 2008 and before 1 June 2009 you may, if eligible, join the New HSC Pension Scheme 2 years after your retirement.

Abatement

If you return to HSC work after claiming your benefits and before age 60, the pension may be subject to abatement.

Index linking

Your HSC pension will be fully index-linked to protect it against inflation. This means that we will increase it each year in line with the cost of living, for as long as it is paid. But if you are made redundant

before age 55, your pension will not attract cost of living increases until you reach age 55. Then your pension will be increased to take account of the rise in the cost of living since the date it was awarded. The increases are paid from April. In the first year of your retirement the amount of increase you get will depend on the date you retire.Lifetime allowance (LTA)

The value of your benefits before any extra membership is added because you are retiring early will be used to test against the LTA.

There is also an HMRC limit of £30,000 on some lump sum payments after which income tax is payable. For example, if the total of the part of the lump sum you get for any membership enhancement plus any redundancy payment you get from your employer comes to £33,000, you will have to pay tax on £3,000.

Your employer can tell you more about whether you may have additional tax to pay

-

Late Retirement

Late Retirement Factsheet – 2008 Section

Introduction

This section provides additional information for members of the 2008 Section of the HSC Pension Scheme. The contents should be read in conjunction with the members guide for the Scheme.

We have taken great care to get the details right at the time of publication but it does not give a complete or legally binding statement of the law and regulations which govern the Scheme.

Nothing in this section can override the Regulations which set out the conditions of entitlement and determine the rate at which benefits are payable. In the event of any conflicting information, the Regulations will prevail.

If you remain in employment after age 65, you may continue to earn pension as long as you stay in the Scheme, up to age 75 or until you reach 45 years service. You will continue to earn pension benefits until you retire. When you take your benefits, any pension earned before age 65 will be increased to take account of the fact that it is being paid later than your Normal Pension Age (NPA). If you take your benefits after age 75 you will not be able to take a lump sum.

Late payment of pension

If you become entitled to a pension after reaching age 65, any of your pension that is earned before you reach 65 will be increased. The pension amount is increased before any commutation (exchange for a lump sum) is made.

Partial Retirement

If you have chosen to take part of your pension and continue working and if your remaining pension was earned partly before and partly after age 65 only the remaining part of your benefits that were earned prior to you reaching age 65 will be enhanced.

Additional Pension

If you have purchased additional pension, either by regular payments or by lump sum, this pension will also be enhanced to allow for it being paid later than your NPA.

Enhancement Factors

Your pension will be enhanced by a factor that is determined by the Scheme actuary, and this will take into consideration the length of time after your 65th birthday and when you are drawing the pension, and also consider your life expectancy.

The following table shows the enhancement factors that will be used to calculate your pension if you retire at the ages shown. If you retire between these ages the enhancement will be adjusted accordingly. Different factors apply to any additional pension that you may have purchased.

Table 1: Example of Late Retirement Factors

Age at Retirement Late Retirement 65 100% 66 105.4% 67 111.1% 68 117.3% 69 124.2% 70 131.7% 71 139.9% 72 149.1% 73 159.3% 74 170.7% 75 182.3% -

Allocation of Pension

What is allocation?

Subject to certain conditions, a member may give up (allocate) part of their pension to provide for a pension, to be paid after their death, to another person. That person may be a spouse, civil partner, nominated partner or someone who is dependent upon the member for support.

Choosing to allocate will result in a reduction to the member’s retirement pension.

If an allocation is made in favour of the spouse, civil partner, or nominated qualifying partner, they will get the allocated pension as well as their survivor’s pension from the scheme.

A member can apply to allocate:

- on making a claim for payment of benefits or, after making a claim, before the date on which the pension is put into payment;

Or if the member is in pensionable employment

- at any time after completing 45 years pensionable membership, if not a

member of the special classes; or - for a member of the special classes, at any time after reaching age 55 and

completing 40 years pensionable membership; or - at any time after reaching age 65 (60 for members of the special classes).

The application should be made using form AW6/11A, which can be found at the back of the ‘guide for pensioners and their dependants’.

Form AW6/11A should then be attached to the application form AW6 or AW6P and sent to HSC Pension Service. When we receive these forms we will send the member a quote to assist them in deciding whether or not they wish to allocate.

A member who applies to allocate part of their pension must be in good health for their age and will need to have a medical examination at their own expense. It is not necessary for the beneficiary to be medically examined, but the member should satisfy themselves that the person is likely to live as long as they are because if the beneficiary dies before the member, the allocation cannot be cancelled under any circumstances, and the allocated part of the pension would be lost forever.

A member can only cancel or change an application to allocate before we accept the application.

How much pension can be allocated?

A member may not allocate more than one third of their pension ensuring a pension for the beneficiary of at least £260.00 a year.

The member’s remaining pension must exceed the beneficiary’s allocated pension.

The amount of pension the beneficiary will receive for each £1 allocated will depend on:

- the member’s age,

- the beneficiary’s age,

- whether the beneficiary is male or female.

The beneficiary’s pension must exceed 1% of the standard lifetime allowance.

-

Retirement Lump Sums (Pensions Commutation)

From both sections of the Scheme you are able to take some of your benefits as a retirement lump sum. Members of the 1995 Section must have contributed to the scheme on or after 1 April 2008. This part of the site describes your entitlement and options and provides some examples to show how these are calculated.

Claiming a bigger lump sum does not affect the level of survivor benefits payable to a partner or dependent child.

The maximum lump sum you can take is 25% of your capital value. This is determined by a limit set by Her Majesty’s Revenue and Customs (HMRC) and adopted by the Scheme Regulations. It applies across your entire pension arrangements so your HSC retirement lump sum may be limited to a smaller amount if you have other pension savings.

1995 Section You will receive a retirement lump sum which is normally three times your annual pension. You also have the option of receiving a larger retirement lump sum and a smaller annual pension.You have to give up some of your pension to get more retirement lump sum. You will receive £12 of lump sum for every £1 of pension you give up. Your capital value is determined by the HMRC rules and is calculated by multiplying your reduced pension by 20 and adding your total retirement lump sum. In the majority of cases the maximum lump sum you can take works out as approximately 5.36 times your 1995 section pension.

Example

A member decides to take a larger retirement lump sum when they retire. They receive £12 of lump sum for each £1 of annual pension given up so they choose to exchange £500 of their annual pension to get an extra £6,000 lump sum, (£500 x £12 = £6,000)The benefits are now:

Pension £9,129.48 – £500 = £8,629.48 per year

Retirement lump sum £27,388.44 + £6,000 = £33,388.44. The maximum lump sum they could take is £21,516 higher than their normal lump sum. They would have to give up £1,793 of their annual pension to get this so the benefits would be: Pension £9,129.48 – £1,793.00 = £7,336.48 per year

Retirement lump sum £27,388.44 + £21,516.00 = £48,904.442008 Section There is no basic lump sum entitlement in the 2008 section but you do have the option of receiving a retirement lump sum by giving up a part of your pension.The capital value of your benefits is determined by HMRC rules and is calculated by multiplying the pension you will receive by 20 and adding any retirement lump sum. The maximum lump sum you can take works out as approximately 4.28 times your 2008 section pension.You have to give up some of your pension to get a retirement lump sum. You will receive £12 of retirement lump sum for every £1 of pension you give up. Example

A member decides to take a retirement lump sum when they retire. They receive £12 of lump sum for each £1 of annual pension given up so they exchange £1,500 of their annual pension to get a retirement lump sum of £18,000. (£1,500 x £12 = £18,000) The benefits are now:

Pension £12,172.62 – £1,500 = £10,672.62 per year

Retirement lump sum = £18,000. The maximum lump sum they could take is £52,164.00. They would have to give up £4,347.00 of her annual pension to get this so their benefits would be: Pension £12,172.62 – £4,347.00 = £7,825.62 per year

Retirement lump sum = £52,164.00 -

Pension Commutation - Increasing your lump sum

Under the HSC Pension Scheme members of the 1995 section will have the option to give up some of their annual pension for an additional tax free lump sum, up to a maximum amount permitted under HMRC rules. This provision is known as “pension commutation”.

Pension is converted to lump sum at the rate of £12 additional lump sum for every £1 of pension given up.

Claiming a bigger lump sum does not affect the level of survivor benefits payable to a partner or dependent child.

Members of the 2008 section of the HSC Pension Scheme and the 2015 CARE Scheme will have the same opportunity to give up part of their pension for a tax free lump sum of up to 25% of pension value or keep all their entitlement as pension – in other words, they can opt to take no lump sum at all.

Example of pension commutation:

Member A has 40 years membership in the 1995 Section and retires on a pensionable pay of £40,000. Standard benefits are a pension of 40/80 x £40,000 = £20,000 per annum and a standard lump sum of £60,000 (annual pension x 3).

An additional lump sum up to a maximum of £47,136 is available. If member A wanted to take this maximum additional lump sum, they would need to give up £3,928 of pension (£47,136/12). Member A’s benefits would then be a pension of £16,072 (£20,000 – £3,928) and a lump sum of: £107,136 (£60,000+ £47,136).

Any amount of additional lump sum (in multiples of £12) up to a maximum of £47,136 can be claimed by Member A. In all cases the amount of survivor pension would be the same.

Member B is a non-protected member of the 2008 Section and has pension benefits in both the 2008 Section and in the 2015 CARE Scheme.

They have 6 years membership in the 2008 Section and retires on pensionable pay of £40,000. Standard benefits in the 2008 Section are a pension of 6/60 x

£40,000= £4,000 per annum and there is no standard lump sum.A lump sum up to a maximum of £17,136 is available. If Member B wanted to take this maximum additional lump sum, they would need to give up £1,428 of pension (£17,136/12). Member B’s 2008 benefits would then be a pension of £2,572 (£4,000 – £1428) and a lump sum of: £17,136.

Member B also has a 2015 CARE Scheme pension of £15,000.

A lump sum up to a maximum of £64,284 is available. If Member B wanted to take this maximum additional lump sum, they would need to give up £5,357 of pension (£64,284/12). Member B’s 2015 benefits would then be a pension of £9,643 (£15,000 – £5,357) and a lump sum of: £64,284.

Members retiring from 2 April 2008:

Members retiring from 2nd April 2008 (the first day members can retire under the terms of the amended scheme) must indicate whether or not they want an additional lump sum by ticking the appropriate box on the form AW6. If they want an additional lump sum they must select either the maximum lump sum permitted or state an additional lump sum in whole pounds (multiples of £12 only), which is not greater than the permitted maximum lump sum.

Exceptions in the 1995 Section would be married male members with membership prior to March 1972 who have not bought ‘unreduced lump sum’.

Pension Commutation

Q. What is pension commutation?

A. Members of the 1995 Section of the HSC Pension Scheme have the option to give up some of their annual pension for an additional tax-free lump sum, up to a maximum amount permitted under the HM Revenue and Customs (HMRC) rules. Members of the 2008 Section of the HSC Pension Scheme and the 2015 CARE Scheme need to give up some of their annual pension in exchange for a tax-free lump sum.Q. Who is eligible for pension commutation?

A. Members who are contributing to either the 1995 or 2008 section of the HSC Pension Scheme. Members of the 2015 CARE Scheme are also eligible.Q. Is there a limit on the amount of pension that I can give up for a tax-free lump sum?

A. Yes, up to 25% of the capital value of your pension.Q. How much does it cost?

A. Your pension would be converted to a lump sum at the rate of £12 additional lump sum for every £1 of pension given up.Q. Do I have to commute part of my pension?

A. No, you don’t have to commute anything. You can take the usual pension and lump sum in the 1995 section of the Scheme, which is normally three times the pension amount, or only a pension in the 2008 section and the 2015 CARE Scheme.Q. Is there a facility for me to calculate my benefits if I opt to commute part of my pension.

A. Yes, the Pension Communication Calculator. However before using the calculator you will need to know your estimated pension and lump sum amount at retirement.You will be able to enter your expected pension and lump sum and look at different scenarios, from giving up £1 pension to the maximum permitted. Employers with access to our estimate tools can also provide this for you.

Please note that this calculator is for all members of the HSC Pension Scheme.

Q. Who do I contact to request an estimate of my pension benefits?

A. Members are entitled by law to request up to one estimate of pension and dependents benefits per year. If you are currently employed by the HSC or directional body contact your employer’s payroll department to request your estimate. If you have ceased HSC employment, contact HSC Pension Service by telephone, letter or e-mail to request an estimate of benefits. -

Trivial Commutation

Finance Act: Trivial Commutation

Background

From 6 April 2006 HM Revenue & Customs (HMRC) have changed the criteria for paying small pensions as a one off payment. This is known as Trivial Commutation. From 27 March 2014 the commutation limit was amended to a fixed amount of £30,000 therefore where the capital value of all a members’ pension savings is less than £30,000 they may be able to trivially commute their pension. The procedure for assessing this is as follows:

For amounts less than 0.48% of the standard lifetime allowance the member will be sent a choice letter and it is their decision to either take a pension only (2008 section), pension and pension commencement lump sum or to have the pension commuted into a once and for all payment.

For amounts 0.48% to 2.4%* of the standard lifetime allowance the benefits are automatically paid as a pension and lump sum (or a pension only in the 2008 section), unless the member asks for their pension to be commuted. This request should be made at awarding stage; however there is no statutory provision to prohibit the cancelling of an award and replacing the pension with a trivially commuted payment, if that is the member’s wish.

*The percentage may change depending on the current lifetime allowance but the capital value limit will remain at £30,000. Current this equates to:

Fixed capital value £30,000 / current LTA £1,250,000 x 100 = 2.4%

1995 Section: For HSC Pension Scheme the capital value = Pension x 20 + Lump Sum of the actual benefits payable.

2008 Section: For HSC Pension Scheme the capital value = pension x 20 of the actual benefits payable. As there is no actual entitlement to a lump sum in the 2008 section the capital value is based on the member’s pension before commutation of pension to lump sum.

If trivial commutation applies the member can receive their normal benefit entitlement to a lump sum tax free. However, any pension commuted is taxed through PAYE for the tax year in which the payment is made.

From 27th March 2014 where a member’s total payment, trivial commutation pension plus pension commencement lump sum, is less than £10,000 they may elect at awarding stage to commute their pension. This is regardless of whether the capital value of all their pension benefits, including those outside the HSC Pension Scheme, is less than the commutation limit of £30,000 (2.4% of the standard lifetime allowance of £1.25m)

A trivially commuted pension and pension commencement lump sum may be payable to a member who is over age 75 at the time of payment.

Pension Commutation

1995 Section: If a member retires and their last day of pensionable membership is 1st April 2008 onwards and a member’s actual entitlement to benefits falls below 2.4%* of the standard lifetime allowance, under the HSC Pension Scheme (Amended 2008) regulations a member can still choose to reduce their pension to give a bigger lump sum. The reduced pension will then be commuted and taxed through PAYE and the increased lump sum will be paid tax free.

2008 Section: Members of the 2008 section are normally entitled to a pension only, however the pension can be commuted to provide for a lump sum.

Survivor Pension

When a member chooses to commute their benefits into a one off lump sum, the survivor pension is also taken into account with the calculations and all liabilities for a survivor pension are discharged. Any death benefit lump sum will be discharged once the payment has been made.

Where there is prospective entitlement to a child’s allowance, a member cannot commute their pension and their scheme benefits must be taken in the form of a pension and lump sum or pension only (2008 Section).

Pensions Increase

As the pension benefits are being paid as a one off lump sum, any pensions increase that will become due after payment will be included in the state pension.

State Pension Age and GMP Age

From 6th April 2010 changes were introduced to equalise the State Pension Age (SPA) between females and males, which amended the SPA gradually from 60 to 65 for females born on or after 6th April 1950.

The Guaranteed Minumum Pension (GMP) age however remains unchanged, this being 60 for females and 65 for males. From December 2018 to October 2020 the SPA will gradually increase to 66 for both females and males.

Male member under age 65

A member who retires before age 65 and has entitlement to a GMP cannot elect to trivially commute their pension benefits. If this applies, we will automatically pay the member their standard pension and lump sum.

Pension arrangements elsewhere

A payment of a one off lump sum depends on whether you have pension arrangements elsewhere and the value of these benefits. If this applies we will automatically pay the member their standard pension and lump sum.

Pension arrangements elsewhere

The payment of a one off lump sum depends on whether they have pension arrangements elsewhere and the value of these benefits. If the total value of the other benefits takes them over 2.4% of the standard lifetime allowance then only a pension and lump sum can be paid regardless of the amount.

When a member completes their application form AW6 they will inform us in Part 5 whether they have any other pension arrangements other than the HSC Pension, the State Pension or any survivor benefits. If a members does have arrangements elsewhere then we will send them an additional form to complete, whih will ask for further information about their other pension benefits with the options letter.

The form will ask for values of their pension benefits that a member has elsewhere. The information required is dependent on whether the benefits are in payment or not and if they are in payment, when they were first put into payment.

- We require the Gross Annual Pension before income tax is deducted if the benefits are in payment prior to 6th April 2006.

- We require the percentage of lifetime allowance that these benefits have used if the benefits are in payment after 5th April 2006.

- We require the Capital Value of these benefits on the date nominated by the member if the benefits are not yet in payment. This information must be provided by the other pension arrangements.

If the member was in pensionable employment after the nominated date, then a trivial commutation cannot be paid.

If a member has received pension benefits from another pension provider that was converted to a one-off lump sum and paid after 6th April 2006, we need to know what the nominated date is and any subsequent payable dates. This is because a one-off lump sum can only be paid up to 12 months after a nominated date. Any benefits after this date must then be paid as a separate pension and lump sum.

If all of the member’s other arrangements and their HSC Pension benefits are above 2.4%* of the standard lifetime allowance, we will have to pay the benefits as a separate pension and lump sum. However, it is possible for a member to trivially commute their benefits if their total payment, trivial commutation pension, plus pension commencement lump sum is less than £10,000.

Substitute Awards

Where HSC Pension Scheme has paid a trivial commutation award before 6th April 2006, the member is permitted one further trivial commutation payment after 6th April 2006 provided they meet the trivial commutation conditions.

Where HSC Pension Service has paid a Trivial Commutation Lump Sum on or after 6th April 2006, only one trivial commutation lump sum is permitted from the Scheme. The payment of an additional trivial commutation lump sum would be an unauthorised payment, with the member and the Scheme subject to tax charges.

If a revision to a trivial commutation award is received, any additional pension entitlement must be paid as a separate pension and lump sum unless the additional commuted amount is £10,000 or less.

A member normally has only one 12 month period in which to commute any trivial benefits commencing with the nominated date. However, if the total of the additional trivial commutation and pension commencement lump sum is £10,000 or less the extra pension benefits can be commuted outside this period and will not result in an unauthorised payment.

-

Injury/Ill-Health Benefits

The below section gives more information on how to apply for Ill-Health or Injury benefits.

-

Returning to Work with a Tier 2 Ill-Health Pension

This section sets the restrictions for those members who have retired on a tier-2 ill health pension (meaning that they have satisfied the medical advisers that they are permanently incapable of engaging in any regular employment because of the illness or injury) and now feel well enough to return to work.

If you want to retain your Tier 2 ill health pension there are restrictions based on the kind of work you do and the amount of money you earn. These restrictions differ primarily on whether you return to work in the HSC or not. There are two restrictions for those who return to work in the HSC (see Section 1 and 2 respectively) and one for those outside HSC work (see Section 2 only).

You should also be aware that under the rules governing the continued receipt of a tier- 2 ill health pension you will be subject to an annual review. The details of this are set out in Section 3.

Section 1 – How much time you can spend working in the HSC

Only applies to those working in the HSCThere is a restriction where you cannot work for more than 12 months in the HSC and keep your tier-2 ill health pension. The start of the 12-month period in which you can do work in the HSC starts on the day you first restart work in the HSC after

your retirement.If you do any work in the HSC after this 12-month period has ended, your tier 2 ill-health pension will be substituted with a tier 1 ill-health pension. You will not be able to regain your tier-2 ill-health pension – under any circumstances – if you break this restriction.

For example, if you decided to restart working in the HSC on 09 August 2015, then you could only do work in the HSC from 09 August 2015 to 08 August 2016. Any work done in the HSC after 08 August 2016 would result in your tier 2 ill-health pension being substituted with a tier 1 ill-health pension. You would not be able to get your tier 2 ill- health pension back, if this were to happen.

If you break this restriction, your tier 2 ill-health pension will be substituted on the first pension payment date after the first day spent working in the HSC after the 12-month period ended.

If you decide to restart work in the HSC, you must tell HSC Pension Service immediately of the date you started work.

Please also note that if you return to work in the HSC after retiring with a tier 2 ill-health pension, your pension may also be subject to abatement.

Section 2 – Restricting your earnings while working

Applies to both HSC and Non HSC workThere is a restriction where your gross earnings in any given tax year must not exceed the lower earnings limit (LEL) for primary class-1 national insurance contributions for that tax year. (Your gross earnings are what you are paid before any deductions (such as income tax and national insurance contributions) are taken out).

The LEL is set by HM Revenue & Customs and the value for any given tax year can be found in the following location on the HM Revenue & Customs website:

http://www.hmrc.gov.uk/rates/nic.htmPlease note that the LEL amounts are published as weekly amounts. The annual amount is calculated by multiplying the weekly amount by 52. For example, the weekly amount of the LEL for tax year 2016-17 is £112. Therefore, the annual amount of the LEL for that tax year is £5,824 (£112 × 52 weeks).

If, in the course of working, your earnings exceed the annual LEL in any given tax year, your tier-2 ill-health pension will be substituted with a tier-1 ill-health pension. However, you may have an opportunity to regain your tier-2 ill-health pension.

If you break this restriction, your tier-2 ill-health pension will be substituted on the first pension payment date after the day your earnings exceeded the annual LEL.

The day your earnings exceeded the annual LEL is the date you received the pay that caused your earnings to exceed the annual LEL.

For example, imagine that you restart work in tax year 2016-17 and earn £1,000 a month, gross. After six months your gross earnings will be £6,000. These earnings are in excess of the £5,824 annual LEL for tax year 2016-17. At the end of the fifth month your gross earnings will have amounted to £5,000, which is under the annual LEL. Therefore, the date you were paid your salary for the sixth month’s work is the day your earnings exceeded the annual LEL.

If you decide to restart work you must keep your payslips, and tell HSC Pension Service immediately when your earnings are about to exceed the annual LEL.

HSC Pension Service will ask you to provide the payslip that took your earnings over the annual LEL, in order to determine the day your earnings exceeded the annual LEL.

Regaining your Tier 2 ill health pension after exceeding the LEL

As mentioned above you may have the opportunity to regain your tier-2 ill-health pension if you exceed the LEL (HSC workers cannot regain if they have broken or will break Restriction 1).

- To do this you must first be under normal pension age*.

- Second, you must stop working altogether

- Third, you must submit to HSC Pension Service new medical evidence for your condition now. The medical evidence must be submitted before the submission deadline which is 12 months after the day you first restarted work after your retirement.

All three of these conditions must be satisfied for you to have the opportunity to regain your tier 2 ill-health pension.

If you are under normal pension age, you have stopped working and your medical evidence is submitted in time, your evidence will be assessed by HSC Pension Service’s medical advisors. If the medical advisors determine that your condition still satisfies the criteria necessary for a tier-2 ill-pension, your tier-2 ill-health pension will be reinstated from the date the medical advisor makes their determination.

If you start working again after your tier-2 pension has been reinstated and your earnings exceed the annual LEL once again, your tier-2 ill-health pension will be substituted with a tier-1 ill-health pension as described above, but you will not be allowed a second opportunity to regain your tier 2 ill-health pension.

Section 3 – Annual Review of Tier 2 Ill Health Pensioners

After the end of each tax year, HSC Pension Service will review the earnings and employments of all pensioners in receipt of tier 2 ill-health pensions. This will include those pensioners who have been awarded tier 2 ill-health pensions having originally been awarded a tier 1 ill-health pension with a right of review.

As the review will look back over the previous tax year, you are advised not to wait for this review before telling HSC Pension Service about any earnings or work you may have done. Waiting for a review before telling HSC Pension Service about any work you have done may result in an overpayment of benefit that you must repay.

Furthermore, waiting for the review may limit – or, at worst, eliminate – the time available to regain your tier 2 ill-health pension and you may be left permanently with a tier 1 ill-health pension.

*Your normal pension age is 60 years if you retired from the 1995 Section of the HSC Pensions Scheme. Your normal pension age is 65 years if you retired from the 2008 Section of the HSC Pension Scheme. Your normal pension age is the higher of 65 years or your State Pension Age if you retired from the 2015 Section of the HSC Pension Scheme.

-

Partial Retirement

Information on the Proposed Flexibilities for Partial Retirement can be found here.

Partial Retirement for 2008 & 2015 Scheme Members only

Introduction:

This section provides additional information for members of the 2008 Section of the HSC Pension Scheme and members of the 2015 HSC Pension Scheme. The contents should be read in conjunction with the members Guide for the Scheme.

We have taken great care to get the details right at the time of publication but it does not give a complete or legally binding statement of the law and regulations which govern the Scheme.

Nothing in this section can override the Regulations which set out the conditions of entitlement and determine the rate at which benefits are payable. In the event of any conflicting information, the Regulations will prevail.

If you reduce your pensionable pay by at least 10% and you have reached the minimum retirement age of 55 you may partially retire and take some of your benefits. The benefits would be reduced if they are paid before your Normal Retirement Age (NRA).

NRA in the 2008 Section of the Scheme is Age 65.

NRA in the 2015 Scheme is the greater of Age 65 or the member’s State Pension Age.Your pensionable pay must remain reduced for at least a year otherwise you will cease to be eligible for the pension that you have taken.

Eligibility

To be able to take part of your pension benefits and continue working you must have reached age 55, the Scheme’s minimum pension age and have at least two years pensionable service. Your terms of employment must have changed and as a result your pensionable pay must also reduce by at least 10%, for at least 12 months. You must choose to partially retire within three months of the reduction in your pay.

Additional Pension

You can choose to take any additional pension you may have purchased, in full, at the same time as you take part of your Scheme benefits or you can leave this to be taken later or when you fully retire.

Applying for partial retirement

You can apply for partial retirement on a form that is available from your employer. Your employer must state that your employment terms have changed and your pensionable pay has reduced by at least 10%.

If you are a member of the 2008 Section of the Scheme and are over your NRA the part of your pension that was earned before you reached your NRA will be increased as it is being paid later than expected.

- Your application must state how much of your pension you wish to apply for (as a percentage of the total).

- Whether you are also applying for any additional pension you may have

purchased.

If you are under your NRA your benefits will be reduced to take account of the fact that they are being paid earlier than expected.

If you a member of the 2015 Scheme and are over your NRA all of your pension accrued will be increased as it is being paid later than expected.

Minimum and maximum amounts available

The minimum value of the pension you can apply to have paid as part of your partial retirement is 20% of your pensionable service at the date you

choose to take some of your benefits and not less than 0.05% of the member’s lifetime allowance.You must continue to have at least 20% of your pensionable service remaining in the Scheme (at least 1 year’s worth) when you take partial retirement. This means that the maximum amount you can apply for is 80%.

Limit on amount of times you can partially

You may choose to take part of your benefits on no more than two occasions. Any remaining pension after two partial retirements must be taken when you finally retire.

Continuing to qualify for your pension

If you have chosen to take part of your pension and your pensionable pay increases within 12 months of its earlier reduction you will cease to be entitled to receive the pension that you have chosen.

Questions

If you are unclear about any aspect of this information or have a specific question that is not answered by the information above, please contact HSC Pension Service.

-

Current Pensioners

Different rules and benefits apply to pensioners (and therefore their dependants) depending on whether they retired on or after 1 April 2008, or before this date.

For those that retired (or died) on or before 1 April 2008, the rules and benefits of the 1995 Section HSC Pension Scheme pre 1 April 2008 rules apply. The changes to the HSC Pension Scheme effective from 1 April 2008 do not affect you, or the entitlements of any dependants you may have. The same rules and benefits will continue to apply to your pension as those described in the Guide for Pensioners and Dependants that you were given when you retired. The Guide for Pensioners and Dependants on this website has been updated with the amended rules and will not be the same version as the one given to you.

For those that retired (or died) on or after 1 April 2008 the rules and benefits of the 1995 Section or the 2008 Section of the HSC Pension Scheme apply. The differences in the rules and benefits for these members are reflected within the Guide for Pensioners and Dependants available in the HSC Pension Scheme Guides section on this website.

If you have a query in connection with payment of your pension, please write to HSC Pension Service, Waterside House, 75 Duke Street, Londonderry, BT47 6FP or contact 028 7131 9111 (Option 3).

In line with HSC Pension scheme regulations, please note that you must inform HSC Pension Service of any changes to your address or bank details. This must be posted or emailed to us in writing and signed by the member. Failure to maintain contact will result in payment of your pension being suspended.

I am considering returning to HSC employment after retirement. Can I rejoin the scheme?

If you retired before 1 April 2008 and return to work in the HSC your employment will not be pensionable unless you retired on ill health grounds and return to work before age 50.

If you leave HSC pensionable employment after 1 April 2008 and retire before the ‘choice’ exercise you will be eligible for pensionable re-employment in the 2008 Section of the HSC Pension Scheme but you must wait at least two years after retirement before doing so.

If you retired after 1 October 2009 then your position is determined by which scheme you retired from. If you had taken the option to transfer to the 2008 Section of the HSC Pension Scheme then any future employments will be pensionable.

If I retire after 1 April 2008 do I still have to take a 24 hour break before returning back to employment and work less than 16 hours per week in the first calendar month to avoid my pension being suspended?

Yes, the same rules apply. If you opt to transfer to the 2008 Section of the HSC Pension Scheme during the Choice exercise, the 24-hour break will still apply but your pension will not be suspended if you work more than 16 hours per week in the first calendar month.

If I return to HSC employment after retirement will my benefits be affected?

In the 1995 Section of the HSC Pension Scheme if you are age 60 or over, or have claimed your benefits early and they have been reduced to pay for early retirement, then your pension will not be affected if you return to work in the HSC.

Likewise, if you are in the 2008 Section of the HSC Pension Scheme if you are age 65 or over, or have claimed your benefits early and they have been reduced to pay for early retirement, then your pension will not be affected if you return to work in the HSC.

Your benefits will also not be affected if you are in receipt of benefits under the “new style” redundancy arrangements. The rationale behind this exception is that

- There are no increases to pensionable service through the new style redundancy arrangements and

- The member will have funded the unreduced element of their pension using some or all of their redundancy compensation lump sum.

Further information can be found within our Pensioners section.

Business Services Organisation

Business Services Organisation