About this guide:

Whether this is the first time you have received a pension savings statement from us, or you have received one for an earlier tax year, the topic of taxation on pensions is complicated and the language used technical and therefore confusing.

The below guide has been published as an aid to:

• help explain why you have been sent a statement;

• give you important information about the annual allowance;

• take you through the figures on your statement; and

• highlight the next steps that you may need to take.

Your statement, along with the information provided in this guide, will help you consider whether you have an annual allowance tax charge to pay to HM Revenue and Customs(HMRC).

Tax is your personal responsibility. The HSC Pension Service and your HSC employer cannot assist you with any tax liability calculations.

You may wish to seek the services of a tax adviser if you are concerned about how the annual allowance may affect your HSC pension benefits or any other pension benefits you may have in a pension scheme outside the HSC.

A tax adviser may also be able to assist you if you had taxable income of more than £110,000 (up to 05/04/20) or £200,000 (from 06/04/20) during the relevant tax year as the annual allowance available to you may have to be tapered down to an amount lower than the standard annual allowance.

The terminology used in this guide is taken from HM Treasury legislation in the Finance Acts and the on-line guidance published by HMRC. There is a glossary at the end of this guide to help explain the more technical terms used and their meanings.

The information in this section is based on our understanding of the tax and legal position at the date of publication and does not allow for any changes that may be communicated by us or HMRC after this date.

If you’d like to access the below information in a printable, PDF format, please click here.

-

Why have you been sent an annual allowance pension savings statement?

There are three reasons why we would send you a pension savings statement.

1. Growth in your HSC pension benefits is more than the standard annual allowance.

We have a legal requirement to send you a pension savings statement if the growth in your HSC pension benefits over a year, known as the pension input period, is more than the standard annual allowance. HMRC call this growth the pension input amount.

If you are a member of the 1995/2008 and 2015 HSC Pension Schemes, and the total pension input amount across both these schemes is more than the standard annual allowance, you will receive two separate statements, one from each HSC scheme.

The standard annual allowance is currently £40,000.

2. You, or a third party, have requested a pension savings statement. This is called an ‘on demand statement’.

If you asked us for a pension savings statement we have sent one to you.

If a third party has asked us for a statement on your behalf we are legally required to send this to you, and not to the third party. It is up to you to pass the statement onto the third party who asked for it on your behalf.

3. You, or a third party, requested a revised statement due to a notification of amended data from your employer.

Your employer has updated us with a change to your pensionable earnings and/or membership and you, or a third party, asked for a revised statement.

Your employer must update us with any changes to your pension record. In turn you must then write to us to ask for a revised statement. A revised statement will not automatically be issued.

4. You are retiring because of ill health.

As a result of a successful Tier 2 health application the HSC pension benefits you are about to receive have been increased.

This could also happen if you have a Tier 1 ill health pension and were also buying added years or additional pension.

5.You are a medical, ophthalmic or dental practitioner.

You are a medical, ophthalmic or dental practitioner, and do not fall into one of the above four groups.

We are mindful that a significant number of out practitioner members may have pensionable savings in other pension schemes outside the HSC and are more likely to request an on demand statement from us.

-

What's in your pension savings statement?

1. Pension Scheme Tax Reference (PSTR)

Each HSC scheme has its own PSTR. If you have an annual allowance charge you will need this number when you are completing your self-assessment tax return.

2. Pension Input Period

This is the period over which the growth in your pension savings is measured. From 2016/2017 it is now aligned with the tax year.

3. Relevant tax year pension input amount

This is the growth in the value of your HSC pension’s benefits over the pension input period.

If you are a member of the 1995/2008 and 2015 HSC Pensions Schemes or another pension scheme, you will have a pension input amount in each pension scheme that you must add together in order to determine if you have an annual allowance charge.

4. The standard annual allowance

This is the standard annual allowance for the tax year across all your pension schemes. You do not have a separate annual allowance for each pension scheme you are a member of.

Your annual allowance could be lower and you need to read the sections below to see if you are affected by either the tapered or alternative annual allowance.

5. Pension input amounts for the last three tax years

Unused annual allowance from the last three tax years can be added to the relevant tax year’s annual allowance.

If the pension input amount in one of these years is less than your annual allowance you will have some unused annual allowance to carry forward. Remember – your annual allowance may be lower than the standard annual allowance shown.6. Tax year 2015/2016

This combined pension input amount is split between the pre and post alignment tax years.

-

Your 1995/2008 HSC Pension Scheme - Annual Allowance Pension Savings Statement

Pension Scheme Tax Reference (PTSR) 008215816Y

Relevant Tax Tear

Your pension input in the relevant tax year is:

Pension Input Period Start Pension Input Period End Standard Annual Allowance (Across all of your pension schemes) Pension Input Amount (Growth) in the 1995/2008 HSC Pension Scheme 06/04/2017 05/04/2018 £40,000 £59,850 If you were also a member of another pension scheme during this tax year, this includes the 2015 HSC Pension Scheme or any other pension scheme, in order to assess if you have an Annual Allowance tax charge you must add together the pension input amounts for 2017/18 from all of your pension schemes and then compare this total amount against the Annual Allowance available to you.

Carry Forward Tax Years

Your pension input amounts in the last three years are:

Pension Input Period Start Pension Input Period End Standard Annual Allowance (across all of your pension schemes) Pension Input Amount (Growth) in the 1995/2008 HSC Pension Scheme 06/04/2016 05/04/2017 £40,000 £38,000 01/04/2015 05/04/2016 £0.00 £23,275.00 Pre-Alignment Tax Year 01/04/2015 08/07/2015 £80,000 £6,209.77 Post-Alignment Tax Year 09/07/2015 05/04/2016 £0.00 £17,065.23 01/04/2014 31/03/2015 £40,000 £43,663 No carry forward figures in your statement

You either joined, or moved, to the 2015 HSC Pension Scheme during the relevant tax year or you were a deferred member of the 1995/2008 or 2015 HSC Pension Scheme for the entire previous three pension input periods.

If you were a deferred member the pension input amount for these carry forward tax years is nil and you could have all the standard or reduced annual allowance from these tax years to carry forward. This is subject to any pension input amount you have during these tax years in another pension scheme.

Carry Forward Tax Years

Your pension input amounts in the last three tax years are:

Pension Input Period Start Pension Input Period End Standard Allowance (across all of your pension schemes) Pension Input Amount (Growth) in the 1995/2008 HSC Pension Scheme Opening and Closing Values

Your pension input amount, shown above for each pension, input period, is the difference between the value of your HSC pension benefits at the start, the opening value, and the end, the closing value, of the pension input period.

Pension input year missing in your statement

You were a deferred member for the entire pension input period.

The pension input amount for the missing carry forward tax year is nil and you could have the standard or reduced annual allowance from this tax year to carry forward. This is subject to any pension input amount you have during the tax year in another pension scheme.

Carry Forward Tax Years

Your Pension input amounts in the last three tax years are:

Pension Input Period Start Pension Input Period End Standard Annual Allowance (across all of your pension schemes) Pension Input Amount (Growth) in the 1995/2008 HSC Pension Scheme 01/04/2014 31/03/2015 £40,000 £8,229.84 Opening and Closing Values

Your pension input amount, shown above for each pension, input period, is the difference between the value of your HSC pension benefits at the start, the opening value, and the end, the closing value, of the pension input period.

Pension Input Period Start Pension Input Period End Opening Value (adjusted in line with inflation) Closing Value 06/04/2017 05/04/2018 £69,502.52 £94,598.71 01/04/2014 31/03/2015 £60,447.17 £68,677.01 £0.00 pension input amount in your statement

Growth in CPI, used when calculating the opening value, outweighs the growth in your pension benefits. This could also occur if your pensionable pay was a lower amount at the closing value compared to that used in the opening value.

Carry Forward Tax Years

Your pension input amounts in the last three tax years are:

Pension Input Period Start Pension Input Period End Standard Annual Allowance (across all of your pension schemes) Pension Input Amount (Growth) in the 1995/2008 HSC Pensions Scheme 06/04/2016 05/04/2017 £40,000 £8,055.04 01/04/2015 05/04/2016 £0.00 £0.00 Pre-Alignment Tax Year 01/04/2015 08/07/2015 £80,000 £0.00 Post-Alignment Tax Year 09/07/2015 05/04/2016 £0.00 £0.00 01/04/2014 31/03/2015 £40,000 £9,375.90 -

How do we calculate your pension input amount?

Your pension input amount (PIA) is the difference between the value of your HSC pension benefits at the beginning, the opening value, and the end, the closing value, of the pension input period.

Any pension contributions you, or your employer on your behalf, has paid into a HSC scheme are not included in the opening and closing value calculations.

The following steps are used to calculate the opening and closing values.

Step 1 We calculate your HSC pension up to the day before the start of the pension input period. The Opening Value Step 2 The Pension is multiplied by a factor of 16. Step 3 If you are a 1995 Section member your automatic retirement lump sum is added to the amount in Step 2. Step 4 The total amount is adjusted in line with inflation to reflect their value at the end of the pension input period. Step 5 We calculate your HSC pension up to the last day of the pension input period. The Closing Value Step 6 The pension is multiplied by a factor of 16. Step 7 If you are a 1995 Section member your automatic retirement lump sum is added to the amount in step 6. Step 8 We deduct the opening value in step 4 from the closing value in step 7. This gives us your pension input amount. PIA Opening and Closing Values

These figures have been calculated using pensionable pay or membership details provided by your employer. It is your employer’s responsibility to ensure this data is correct and up to date.

Pension Input Period Start Pension Input Period End Opening Value (adjusted in line with inflation) Closing Value 06/04/2017 05/04/2018 £671,650 £731,500 06/04/2016 05/04/2017 £627,000 £655,000 01/04/2015 05/04/2016 £603,725 £627,000 01/04/2014 31/03/2015 £545,337 £589,000 Adjustment in line with inflation

The amount at step 4 is adjusted in line with inflation by the 12 month increase in the Consumer Price Index (CPI) to the September before the start of the relevant tax year. CPI percentages for the relevant tax year and carry forward tax years are:

Tax Year CPI% September CPI 2021/2022 0.5% September 2020 2020/2021 1.7% September 2019 2019/2020 2.4% September 2018 2018/2019 3.0% September 2017 2017/2018 1.0% September 2016 2016/2017 0%* September 2015 2015/2016 2.5%** September 2014 2014/2015 2.7% September 2013 2013/2014 2.2% September 2012 *A negative September 2015 CPI resulted in 0% CPI for annual allowance

** changed to 2.5% for annual allowance

-

What was different about tax year 2015/2016?

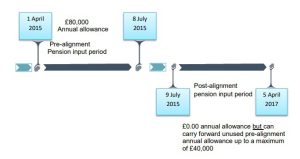

As part of a move for the pension input period in all pension schemes to become aligned to the tax year transitional rules for tax year 2015/2016 were brought in, that introduced two mini tax years, each with a separate pension input period.

Previously pension schemes had been allowed to choose their own pension input periods.

As a consequence of the transitional rules a pension input period open on 8 July 2015 was treated as having ended on that day, with a new pension input period starting immediately afterwards from 9 July 2015 to 5 April 2016.

If you were in active pensionable employment that spanned these dates then you have two mini tax years in 2015/2016, each having a different standard annual allowance.

Pre-alignment tax year 2015/2016 Start of Pension Input Period End of Pension Input Period Standard Annual Allowance Pre-alignment pension input period 1st April 2015 8th July 2015 £80,000 From 1st April 2015 to 8th July 2015 the standard annual allowance was £80,000

Pre-alignment tax year 2015/2016 Start of Pension Input Period End of Pension Input Period Standard Annual Allowance Pre-alignment pension input period 9th July 2015 5th April 2016 £0.00 From 9 July 2015 to 5 April 2016 the standard annual allowance was £0.00, but up to £40,000 of any unused annual allowance from the pre-alignment pension input period could be carried forward to the post-alignment pension input period.

-

What are the steps you may need to take next?

You have read your pension savings statement and are now working your way through this accompanying guide.

Remember if you are a member of both the 1995/2008 and 2015 HSC Pension Schemes you should have received two statements, showing the pension input amounts in each scheme.

You now need to determine if you have an annual allowance tax charge to pay. You can do this by working through the following steps which we have included to assist you.

Step 1 – Work out your total pension input amount in the relevant tax year.

If you have pension savings outside 1995/2008 and 2015 HSC Pension Schemes and have not automatically been sent a pension savings statement by 6 October, following the end of the relevant tax year, you will need to contact your pension scheme provider and ask for one before you can work out your total pension input amount.

You can work out your total pension input amount by adding together the pension input amounts from each pension scheme you were a member of during the relevant tax year.

Step 2 – Determine if you have a tapered annual allowance.

You only need to be concerned about having a lower, tapered annual allowance if you had taxable income of more than £110,000 (up to 05/04/20) or more than £200,000 (from 06/04/20) during the relevant or carry forward tax years from 2016/2017 onwards. If your taxable income was more than £110,000 (up to 05/04/20) or £200,000 (from 06/04/20) you need to determine what annual allowance limit you have for this tax year.

To help you in your determination there is more information about the tapered annual allowance on the ‘What is the tapered annual allowance?’ tab below.

If you’re taxable income during the relevant tax year, or a carry forward tax year, was £110,000 or less (up until 05/04/20) or £200,000 or less (from 06/04/20) you do not need to know about the tapered annual allowance. You will have the standard annual allowance for this tax year, unless you have an alternative annual allowance – see Step 3 below.

Step 3 – Determine if you have an alternative annual allowance

You can only be affected by the lower, alternative annual allowance if you were a member of a money purchase pension scheme during the relevant or carry forward tax years from 2015/2016 onwards. This would include membership of the HSC Money Purchase AVC Scheme or a personal pension.

If you were a member of one of these pension schemes then you need to read the ‘Tapered reduction to annual allowance’ tab below to help you determine if you meet the conditions for having an alternative annual allowance.

If you were not a member of a money purchase pension scheme during the relevant tax year, or the carry forward tax year, you do not need to know about the alternative annual allowance. You will have the standard annual allowance for this tax year, unless you have a tapered annual allowance – see Step 2 above.

Step 4 – Work out if your total pension input amount is more than your annual allowance.

At this point you should have worked out your total pension input amount, across all your pension schemes, and determined what annual allowance limit you have for the relevant tax year. It’s now time to work out if your total pension input amount is more than your annual allowance.

Your total pension input amount will either be equal to, more than or less than your annual allowance. If it is:

a) equal to or less than your annual allowance then you do not have an annual

allowance charge to pay to HMRC.

b) more than your annual allowance you could have an annual allowance charge to pay to HMRC.If you conclude (a)that you do not have an annual allowance charge there is nothing further for you to do. You do not have to tell us or HMRC that you do not have a tax charge.

If you conclude (b) that the total pension input amount is more than your annual allowance the figures in your carry forward tax years now become very important. You can use previously unused annual allowance from these three tax years to increase your annual allowance in the relevant tax year to hopefully reduce or get rid of your annual allowance charge.

Step 5 – Determine what unused annual allowance you have from the previous three tax years to carry forward.

If the conclusion to Step 4 is (b) you now need to return to the figures on your pension savings statement(s) as it gives you the pension input amounts for the previous three tax years.

Similar to Step 1 for each of these three tax years you need to add all your pension input amounts from all your pension schemes together.

If the total pension input amount in one of these periods is less than your annual allowance for that tax year you will have some unused annual allowance to carry forward.

Remember you may need to revisit steps 2 and 3 for some or all of the carry forward tax years to determine what annual allowance limit you had for, 2016/2017 onwards for a tapered annual allowance and 2015/2016 onwards for an alternative annual allowance.

If the total pension input amount in one of the carry forward pension input periods is equal to or more than your annual allowance then you have no unused annual allowance from that year to carry forward.

Having unused annual allowance to carry forward could mean that you have a lower amount of annual allowance charge or even no tax charge to pay. The ‘How can I carry forward my unused annual allowance?‘ tab below has some useful information about carrying forward unused annual allowance.

Step 6 – Determine if you have an annual allowance charge.

If your total pension input amount is equal to or less than your annual allowance, or the annual allowance plus carry forward of unused annual allowance, then you have no annual allowance charge to pay.

If this is the case then there is nothing further for you to do. You do not have to tell us or HMRC that you do not have a tax charge.

However, if your total pension input amount is more than the annual allowance plus carry forward of unused annual allowance then you do have a annual allowance charge to pay and you will need to calculate the tax amount.

HMRC has published annual allowance calculators for you to use at:

www.hmrc.gov.uk/tools/pension-allowance/index.htm.Step 7 – Calculate your annual allowance charge.

By following steps 1 to 6 you have determined that you are liable to an annual allowance charge and now need to calculate how much tax to pay.

The annual allowance charge is not at a fixed rate of tax and is dependent on how much taxable income you earned and the total pension input amount in excess of your annual allowance in the relevant tax year.

To find out how much tax to pay, you will need to work out the rate (or rates) of tax that would be charged if the excess pension input amount was added to your taxable income. This means that the amount of the annual allowance charge can be in whole or in part at 20%, 40% or 45%.

HMRC has published guidance and examples on how to calculate the annual allowance charge in their Pensions Tax Manual at:

www.gov.uk/hmrc-internal-manuals/pensions-tax-manual.Step 8 – Report and pay your annual allowance charge.

You have calculated your annual allowance charge and you now need to inform HMRC

about it and decide how you are going to pay it.The ‘How to report and pay an annual allowance charge?’ tab has information about how to inform HMRC of your annual allowance charge and the options that may be open to you for paying it.

The ‘Scheme Pays’ tab below has details about ‘scheme pays’.

Remember – you do not need to tell HMRC about your total pension input amount if you do not have an annual allowance charge to pay.

-

What is the tapered annual allowance?

You should read this section if you have taxable income of more than £110,000 (up until 05/04/20) or more than £200,000 (from 06/04/20) in a relevant or carry forward tax year from 2016/2017 onwards.

It is up to you to determine if you have a standard annual allowance or a lower, tapered annual allowance. The tapered annual allowance, introduced from 6 April 2016, only affects a relevant or carry forward tax year from 2016/2017 onwards.

The Threshold Income increased from £110,000 to £200,000 from 06/04/20.

Your taxable income is calculated at the end of a tax year in order to determine your annual allowance limit for that year.

Threshold income:

The tapered annual allowance may apply to you if your income is £110,000 or more (up until 05/04/20) / £200,000 or more (from 06/04/20). This is known as your threshold income. It is based on your taxable income after allowing for certain tax reliefs plus the value of certain pension-related salary sacrifice type arrangements.

Threshold income of £110,000 or less (up until 05/04/20)

If you have a threshold income of £110,000 or less for a tax year you will not be subject to the tapered annual allowance.

Threshold income of more than £110,000 (up until 05/04/20)

If you have a threshold income of more than £110,000 you have to determine what your adjusted income is.

A tapered annual allowance will apply to you if, in addition to a threshold income of more than £110,000, you have an adjusted income of more than £150,000.

Threshold income of £200,000 or less (from 06/04/20)

If you have a threshold income of £200,000 or less for a tax year you will not be subject to the tapered annual allowance.

Threshold income of more than £200,000 (from 06/04/20)

If you have a threshold income of more than £200,000 you have to determine what your adjusted income is.

A tapered annual allowance will apply to you if, in addition to a threshold income of more than £200,000, you have an adjusted income of more than £240,000.

Adjusted income

This is your taxable income after allowing for certain tax reliefs, under sections 193(4) and 194(1) of Finance Act 2004, plus the value of your pension savings during the relevant tax year.

HMRC’s Pension Tax Manual has more information about adjusted income at:

www.gov.uk/hmrc-internal-manuals/pensions-tax-manual/ptm057100.Threshold income of more than £110,000 and an adjusted income of more than £150,000 (up until 05/04/20)

If you determine that you have an adjusted income of more than £150,000 your annual allowance, for that tax year, is reduced on a tapered basis.

Threshold income of more than £110,000 and an adjusted income of £150,000 or less (up until 05/04/20)

A tapered annual allowance does not apply to you.

Threshold income of more than £200,000 and an adjusted income of more than £240,000 (from 06/04/20)

If you determine that you have an adjusted income of more than £240,000 your annual allowance, for that tax year, is reduced on a tapered basis.

Threshold income of more than £200,000 and an adjusted income of £240,000 or less (from 06/04/20).

A tapered annual allowance does not apply to you.

-

Tapered reduction to the annual allowance

The standard annual allowance is reduced by £1 for every £2 of adjusted income you earn above £150,000.

If your adjusted income takes your tapered annual allowance below £10,000 for the tax year, your reduced annual allowance for that year is set at £10,000. This means if you have adjusted income of more than £210,000 your annual allowance is set at £10,000.

For more information on how to calculate your adjusted or threshold income visit HMRC’s website at:

www.gov.uk/guidance/pension-schemes-work-out-your-tapered-annual-allowance -

What is the alternative annual allowance?

You should read this section if you are over age 55 and a member of a money purchase pension scheme, this includes the HSC Money Purchase AVC Scheme or a personal pension, in a relevant or carry forward tax year from 2015/2016 onwards.

It is up to you to determine if you have a standard annual allowance or a lower, alternative annual allowance. The alternative annual allowance, introduced from 6 April 2015, only affects a relevant or carry forward tax year from 2015/2016 onwards.

Determine if you have an alternative annual allowance

To have an alternative annual allowance for pension savings in a defined benefit scheme, such as the 1995/2008 and 2015 HSC Pension Schemes, you must also have a money purchase annual allowance for pension savings in your money purchase pension scheme.

Determine if you have a money purchase annual allowance

Pension flexibilities were introduced from 6 April 2015 to give flexible access to money purchase pension savings from age 55.

You will have a money purchase annual allowance in respect of your pension savings in a money purchase pension scheme if you have:

• flexibly accessed pension benefits from a money purchase pension scheme after 5 April 2015; and

• paid pension contributions to a money purchase scheme of more than the money purchase annual allowance.The money purchase annual allowance before 6th April 2017 was £10,000 and £4,000 from 6th April 2017.

-

How can I carry forward my unused annual allowance?

To increase the annual allowance available to you in the relevant tax year you can carry forward unused annual allowance from the previous three tax years.

When you have unused annual allowance

If the total pension input amount in any of the previous three tax years is less than your annual allowance for that year you will have unused annual allowance which you could carry forward.

For each of the three tax years you need to determine the:

• total pension input amount by adding together all your pension input amounts from all your pension schemes; and your

• annual allowance limit.Unused annual allowance is added to the relevant tax year’s annual allowance to give you more available annual allowance in order to off-set against that year’s total pension input amount.

Carry Forward Tax Year Annual Allowance 2020/2021 Standard, Tapered or Alternative 2019/2020 Standard, Tapered or Alternative 2018/2019 Standard, Tapered or Alternative 2017/2018 Standard, Tapered or Alternative 2016/2017 Standard, Tapered or Alternative 2015/2016 Standard or Alternative 2014/2015 Standard 2013/2014 Standard If the total pension input amount in a carry forward tax year is equal to or more than your annual allowance then you have no unused annual allowance from that tax year to carry forward.

When would unused annual allowance be useful?

Having unused annual allowance to carry forward could mean that you have a reduced amount of annual allowance charge or even no tax charge to pay.

How to carry forward your unused annual allowance

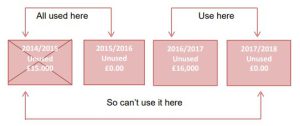

The annual allowance for the relevant tax year should always be used first, followed by any unused from the previous three tax years, beginning with the earliest of these three years, followed by the middle year and the year before the relevant tax year.

Example 1:

Jack’s pension input amount in 2017/2018 is more than the annual allowance and he has the potential for an annual allowance charge. He therefore needs to check whether he has any unused annual allowance from the previous three tax years.

Even though he has unused annual allowance in all three of the previous tax years he must first look at how much unused annual allowance he has from 2014/2015. This amount will either get rid of his charge or reduce it. He uses the unused annual allowance from this year first because if there is still some remaining he will not be able to use this residue amount against a charge in 2018/2019.

If Jack has insufficient unused annual allowance to get rid of the charge from 2014/2015 he then needs to look at his unused annual allowance in 2015/2016 followed if needed by any from 2016/2017.

By carrying forward his unused annual allowance Jack could reduce or totally get rid of the annual allowance charge in 2017/2018.

Unused annual allowance used in a previous relevant tax year

You cannot reuse any annual allowance from one of the three tax years if you have already used it to protect yourself from having an annual allowance charge in a previous relevant tax year.

If you did not exhaust the tax year’s unused annual allowance and the tax year is still within the last three years you can carry forward any remaining amount.

Example 2:

Kate’s pension input amount in 2017/2018 is more than the annual allowance and she has the potential for an annual allowance charge. She therefore needs to check whether she has any unused annual allowance from the previous three tax years that she can carry forward.

She looks at her unused annual allowance from 2014/2015 first. Although she had unused annual allowance in this tax year she has used some or all of it to offset against her annual allowance charge in relevant tax year 2015/2016.

If she used all her unused annual allowance from 2014/2015 then she has nothing to carry forward to 2017/2018. If she has used only some of her unused annual allowance then the residue amount can be carried forward to 2017/2018.

This was because Kate’s pension input amount in 2015/2016 was more than the annual allowance for that tax year and as a result has no unused annual allowance from this tax year to carry forward to 2017/2018.

Carry forward and membership of more than one pension scheme

If you are a member with pension input amounts in both the 1995/2008 and 2015 HSC Pension Schemes or another pension scheme you have only one amount of unused annual allowance. You have to add together all the pension input amounts from these schemes and any other pension scheme to determine how much annual allowance you have not used.

Carry forward and the tapered or alternative annual allowance

If you had a tapered or alternative annual allowance in one of the previous three tax years you need to factor this in when determining the amount of your unused annual allowance. To have any unused annual allowance from these tax years your total pension input amount must be less than your tapered or alternative annual allowance. If your total pension input amount is equal to or more than your tapered or alternative annual allowance you will have no annual allowance to carry forward from this tax year.

If you have a tapered or alternative annual allowance in the relevant tax year any unused annual allowance from the previous three tax years can be carried forward and added to this lower annual allowance limit.

Carry forward from tax year 2015/2016

You must determine if you have any unused annual allowance from the pre-alignment tax year first, up to £40,000 of which can be carried forward to the post alignment tax year. If your total pension input amount for this post-alignment tax year is less than £40,000 you will have unused annual allowance from 2015/2016 to carry forward.

AA of £80,000 AA of £0.00 plus up to £40,000 not already used up by 8th July 2015 6th April 2015 – 8th July 2015 9th July 2015 – 5th April 2016 -

How to report and pay an annual allowance charge?

Paying an annual allowance charge to HMRC

Ultimately you are responsible for paying your annual allowance charge to HMRC.

You can either:

• pay the tax charge directly to HMRC yourself; or

• share that responsibility with the HSC Pension Scheme – this is an arrangement known as ‘scheme pays’ and more details about this is under the ‘What is Scheme Pays’ tab below.Reporting an annual allowance charge to HMRC

If you have an annual allowance charge you will need to tell HMRC about this and confirm how you will pay this amount.

If you usually complete a self-assessment tax return then you must tell HMRC about your pension input amount and liability to the annual allowance charge as part of this return.

You will need to use the supplementary Additional Information form (SA101) of the tax return to confirm that the total pension input amount exceeds your annual allowance.

HMRC has published a help sheet, HS345 – ‘Pensions – tax charges on any excess over the lifetime allowance, annual allowance and on unauthorised payments’ to help you to complete the ‘Pension Savings Tax Charges’ section on page Ai4 of the additional information pages.

You can find the help sheet by inserting ‘HS345’ into the search box at www.gov.uk.

If you do not usually complete a self-assessment tax return or it has been some time since you last did so you will need to register for one by completing form SA1.

It can take up to 20 working days to complete HMRC’s registration process at the end of which you will be given a Unique Taxpayer Reference (UTR).

You can register on line by inserting ‘SA1’ into the search box at www.gov.uk.

We also have to make a report to HMRC

We must report any pension savings statement issued during a tax year if the pension input amount in the 1995/2008 or 2015 HSC Pension Scheme is more than the standard annual allowance.

If you pay the annual allowance charge yourself

You must pay your annual allowance charge to HMRC by 31 January, following the end of the relevant tax year. There may be interest applied if the annual allowance charge is paid after this date.

If you ask HSC Pensions to pay the annual allowance charge

You will need to know the scheme’s pension scheme tax reference (PSTR) number.

These are:

1995/2008 HSC Pension Scheme – 008215816Y

2015 HSC Pension Scheme – 00821581RYMembers of both the 1995/2008 and 2015 HSC Pension Schemes

The SA101 only allows one annual allowance charge and one PSTR number. If you want both of these schemes to pay your charge then you need to add together the charges from each scheme and insert one of the above PSTRs.

Next, in the additional information part of this form you will need to include a note of the annual allowance charge for each scheme and provide the second PSTR.

Self-assessment forms already submitted to HMRC

If, after reading this page, you think you may have submitted an incorrect tax return or SA101 you have one year to make any changes.

For more information on changing a tax return visit: www.gov.uk/self-assessment-tax-returns/corrections

-

What is Scheme Pays?

You can notify us in writing if you want the 1995/2008 or 2015 HSC Pension Scheme to pay your annual allowance charge. In return for paying your tax charge your HSC pension benefits will be reduced.

Scheme pays election and deadlines

If you want us to pay your annual allowance charge to HMRC you need to complete the scheme pays election notice (SPE2) available on our website – please ensure you use the current version of the election notice.

In order for us to be able to accept your election we must receive it by the 31 July deadline date below.

The 31 July deadline is the same for both mandatory scheme pays and voluntary scheme pays. If you have received your Annual Allowance Statement after 31 July in the year following the tax year we will accept a Scheme Pays Election but only if this is received within 3 calendar months from the date of the Statement.

Annual Allowance Charge in Deadline 2021/22 31st July 2023 2020/21 31st July 2022 2019/20 31st July 2021 2018/19 31st July 2020 2017/18 31st July 2019 2016/17 31st July 2018 You should complete and send us your election earlier if before the deadline one of the following events will take place, either you:

• retire – the election should be completed and sent to us at the same time or before

your retirement application is completed; or

• reach age 75 – the election should be completed and received by us before your 75th birthday.Once your election is accepted for scheme pays you are unable to withdraw it, although you have up to four years to change it.

The same 31 July deadline applies.

Members of both the 1995/2008 and 2015 HSC Pension Schemes

If you want both HSC schemes to pay your annual allowance charge then these will be separate elections on the SPE2 form.

You need to tell us how much of the annual allowance charge you want each scheme to pay. Because we treat them as separate elections you need to complete parts B and C before the deadline date. It is not possible to elect for one scheme to pay all your charge.

How much of your annual allowance charge the 1995/2008 and 2015 HSC Pension Schemes can pay depends on the pension input amount in each scheme.

You will need to add up the pension input amounts from the two pension savings statements we sent you.

You can make an election even where the pension input amount in one or both schemes is under your annual allowance, as long as the total pension input amount from both schemes is more than your annual allowance.

The method of splitting the annual allowance charge between the 1995/2008 and 2015 HSC Pension Scheme is confirmed in the factsheet ‘Scheme Pays facility for transition members’ on our website.

Mandatory scheme pays:

We will accept an election if all of the following conditions have been met:

1. Your election is received by us by the deadline; and

2. The pension input amount in the 1995/2008 or 2015 HSC Pension Scheme is more than the standard annual allowance; and

3. The annual allowance charge for the tax year is more than £2,000 (this is across all

your pension schemes).Mandatory scheme pays can only be used for an annual allowance charge calculated from a pension input amount, in the 1995/2008 or 2015 HSC Pension Scheme that is more than the standard annual allowance.

Voluntary Scheme Pays:

It is up to individual pension schemes whether or not they want to offer scheme pays, on a voluntary basis, to their members where the conditions for mandatory scheme pays are not met.

If you have an annual allowance charge occurring in 2016/2017 we only offer voluntary scheme pays if you are a member of both the 1995/2008 and 2015 HSC Pension Schemes and:

1. Your election is received by us by the deadline; and

2. The total pension input amount in the 1995/2008 and 2015 HSC Pension Scheme is more than the standard annual allowance; and

3. The annual allowance charge for the tax year is more than £2,000 (this is across all your pension schemes).From 2017/18 onwards voluntary scheme pays can be used if you are subject to Tapered Annual Allowance.

Example:

Patrick has a pension input amount in 2017/2018 of £78,000, a reduced tapered annual allowance of £10,000 and a higher rate of income tax of 45%.

He determines that he has an annual allowance charge to pay on a pension input amount of £68,000 (£78,000 – £10,000). His annual allowance charge is £30,600 (£68,000 x 45%).

Mandatory scheme pays only covers the annual allowance charge on the pension input amount that is more than the standard annual allowance. Therefore, although his annual allowance charge is £30,600 Patrick can only ask us to pay £17,100 (£78,000 – £40,000 = £38,000 x 45%) by mandatory scheme pays.

Without voluntary scheme pays Patrick would have to pay an annual allowance charge of £13,500 (£78,000 – £38,000 – £10,000 = £30,000 x 45%) directly to HMRC. However, he can now ask us to pay his 2017/2018 annual allowance charge for him under our extended voluntary scheme pays provisions.

Mandatory or voluntary scheme pays

The pension input amount in the 1995/2008 HSC Pension Scheme, the 2015 HSC Pension Scheme or the total pension input amount across both schemes when added together will determine whether your scheme pays election when received is mandatory or voluntary.

HSC Scheme Pension Input Amount Total Amount Scheme Pays 1995/2008 Under standard annual allowance Under Voluntary 2015 Under standard annual allowance 1995/2008 Under standard annual allowance Over Voluntary 2015 Under standard annual allowance 1995/2008 Under standard annual allowance Over Voluntary 2015 Under standard annual allowance Mandatory* 1995/2008 Under standard annual allowance Over Mandatory* 2015 Under standard annual allowance Voluntary 1995/2008 Under standard annual allowance Over Mandatory* 2015 Under standard annual allowance The maximum amount of scheme pays

The maximum amount of annual allowance charge you can ask us to pay is the charge which has been calculated from the pension input amount in the 1995/2008 or 2015 HSC Pension Scheme that is over the standard, tapered or alternative annual allowance. You cannot ask us to pay an annual allowance charge you have incurred in another pension scheme.

If you are a member of both the 1995/2008 and 2015 HSC Pension Schemes this is the total pension input amount across both schemes.

*any pension input amount between your reduced annual allowance and the standard annual allowance is voluntary.

Scheme pays and the tapered annual allowance

As a consequence of having a tapered annual allowance part of your annual allowance charge may not satisfy the mandatory scheme pays conditions.

If you have adjusted income of more than £150,000 this could result in you having an annual allowance charge of up to £13,500, if you had a taxable income of £210,000 or more.

This is the part of the annual allowance charge on a pension input amount of £30,000, the difference between the tapered annual allowance of £10,000 and the standard annual allowance of £40,000, and a higher rate of income tax of 45%

Scheme pays and the alternative annual allowance

Similar to the above, from 2017/2018 you can ask us to pay the part of your annual allowance charge calculated from the pension input amount between the alternative annual allowance and the standard annual allowance on a voluntary scheme pays basis.

How we recover the cost of scheme pays

The amount of annual allowance charge paid by the HSC Pension Scheme is recorded as a separate account on your pension record, known as a notional negative defined contribution (DC) account.

In basic terms this account is very similar to us loaning you the money now to pay your annual allowance charge which you will then have to pay back, with interest, when you either retire or if you transfer out.

At retirement the total account owing, including interest, is converted into a debit amount to be permanently deducted from your HSC pension benefits.

The Scheme Actuary has provided actuarial factors to convert the total account owing into a benefit reduction. Separate factors are provided for ill-health retirement cases to reflect reduced life-expectancy.

1995 Section members

If you are a 1995 Section member your pension and lump sum will be permanently reduced when you retire.

2008 Section members

If you are a 2008 Section member your pension will be permanently reduced when you retire.

2015 Scheme members

If you are a 2015 Scheme member your pension will be permanently reduced when you retire.

Scheme transition members

If you are a member of both the 1995/2008 and 2015 HSC Pension Schemes there will be a separate benefit reduction in each scheme. The reduction is apportioned based on each scheme’s pension input amount and the combined pension input amount across both schemes.

What you should be aware of when asking for voluntary scheme pays

If we pay all or part of your annual allowance charge on a voluntary scheme pays basis you will remain solely liable for the charge until it is paid.

You are responsible for any late payment interest and/or penalties HMRC may charge if the annual allowance charge is paid after the self-assessment tax return deadline of 31 January.

The HSCBSA, HSC Pension Schemes and your HSC employer do not accept any liability for interest and/or penalty charges in respect of your voluntary scheme pays election.

You must arrange to pay any interest and/or penalties directly to HMRC.

Tax Year 2017/2018 Onwards Scheme Pays Mandatory Voluntary Conditions Pension input amount in the 1995/2008 or 2015 HSC Pension Scheme is more than the standard annual allowance and the charge is more than £2,000. Either, the pension input amount in the 1995/2008 or 2015 HSC Pension Scheme is (i) under the standard annual allowance, or (ii) you are a member of both schemes and added together it is more than the standard, tapered or alternative annual allowance. Election deadline 31st July (following the January in which the charge must be declared on your tax return) Liability Shared – you and HSC You alone It is important if you are estimating the annual allowance charge to provide us with a ‘best estimate’ on the SPE2. Because we pay voluntary scheme pays earlier than mandatory scheme pays this will help reduce the amount of interest HMRC will ask you to pay if you change your election because the annual allowance charge to be paid by voluntary scheme pays has increased.

If you die after making a scheme pays election

If you die before we have paid the annual allowance charge to HMRC we will cancel your election and your estate will retain the liability for it.

If we have paid the tax charge to HMRC and you die:

• before your retirement – the total amount owing is written off by us; or

• after your retirement and your pension benefits had already been reduced – this will have a consequential effect on the amount of initial dependent’s pension payable as this is based on the reduced pension in payment at the time of death. A continuing dependent’s pension will be calculated on your unreduced pension.Interest on the notional negative DC account.

Interest is added to the account based on:

• the previous September’s CPI figure; plus

• The Superannuation Contributions Adjusted for Past Experience (SCAPE) discount rate.

The SCAPE is variable.Dates SCAPE discount rate Up to 15th March 2016 3.0% From 16th March 2016 2.8% From April 2019 2.4% Interest applies from 1 January following receipt of your election until retirement benefits become payable or pension rights are transferred out.

Tax Year Scheme Pays Deadline Interest Applied from 2021/2022 31st July 2023 1st January 2024 2020/2021 31st July 2022 1st January 2023 2019/2020 31st July 2021 1st January 2022 2018/2019 31st July 2020 1st January 2021 2017/2018 31st July 2019 1st January 2020 2016/2017 31st July 2018 1st January 2019 The Scheme Actuary reserves the right to change the amount of interest charged.

-

What are the key dates for annual allowance?

The key dates that you need to know about for annual allowance are

6th April each year – is the start of the pension input period.

6 July each year – is the deadline for employers to send membership and pay information for the previous scheme year to us.

31 July each year – is the deadline for members to send in their scheme pays election to us for an annual allowance charge.

6th October each year – is the deadline for us to send you a pension savings statement if the growth in your HSC benefits is more than the standard annual allowance.

This is dependent on the employer updating us with the correct membership and pay information by 6 July.

31 January each year – is the latest date for submission of a self-assessment tax return on line.

5 April each year – is the end of the pension input period.

-

Where can I find out more information about the annual allowance?

The annual allowance page on our website has a number of factsheets on the following subjects, pertaining to the annual allowance that may be useful to you.

You can also find more information in HMRC’s Pensions Tax Manual at:

https://www.gov.uk/hmrc-internal-manuals/pensions-tax-manual

Business Services Organisation

Business Services Organisation